Question: Q1 Multiple-Choice Questions (5 marks) 1. A business is using items to track inventory in MYOB. At the end of a period, inventory as per

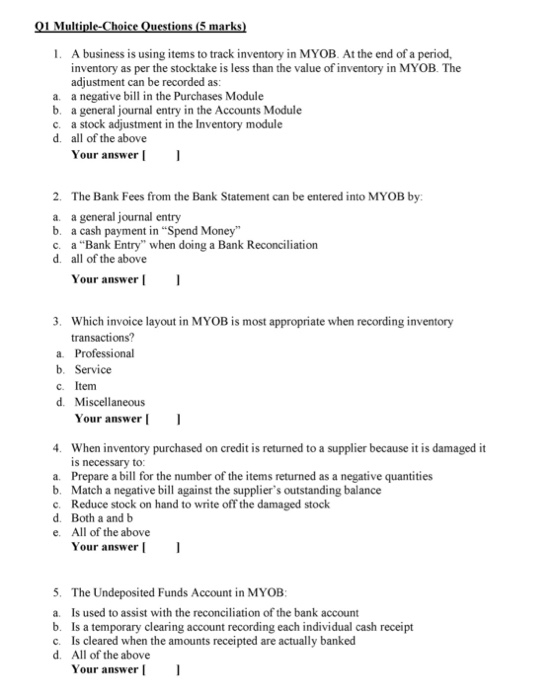

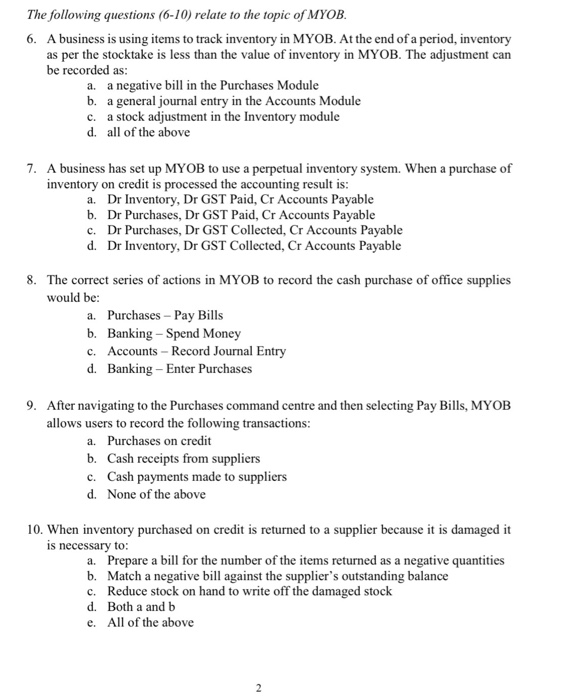

Q1 Multiple-Choice Questions (5 marks) 1. A business is using items to track inventory in MYOB. At the end of a period, inventory as per the stocktake is less than the value of inventory in MYOB. The adjustment can be recorded as: a. a negative bill in the Purchases Module b. a general journal entry in the Accounts Module c. a stock adjustment in the Inventory module d. all of the above Your answer 2. The Bank Fees from the Bank Statement can be entered into MYOB by a. a general journal entry b. a cash payment in "Spend Money" c. a "Bank Entry" when doing a Bank Reconciliation d. all of the above Your answer 3. Which invoice layout in MYOB is most appropriate when recording inventory transactions? a. Professional b. Service c. Item d. Miscellaneous Your answer 4. When inventory purchased on credit is returned to a supplier because it is damaged it is necessary to: a. Prepare a bill for the number of the items returned as a negative quantities b. Match a negative bill against the supplier's outstanding balance c. Reduce stock on hand to write off the damaged stock d. Both a and b e. All of the above Your answer 5. The Undeposited Funds Account in MYOB: a. Is used to assist with the reconciliation of the bank account b. Is a temporary clearing account recording each individual cash receipt c. Is cleared when the amounts receipted are actually banked d. All of the above Your answer The following questions (6-10) relate to the topic of MYOB. 6. A business is using items to track inventory in MYOB. At the end of a period, inventory as per the stocktake is less than the value of inventory in MYOB. The adjustment can be recorded as: a. a negative bill in the Purchases Module b. a general journal entry in the Accounts Module c. a stock adjustment in the Inventory module d. all of the above 7. A business has set up MYOB to use a perpetual inventory system. When a purchase of inventory on credit is processed the accounting result is: a. Dr Inventory, Dr GST Paid, Cr Accounts Payable b. Dr Purchases, Dr GST Paid, Cr Accounts Payable c. Dr Purchases, Dr GST Collected, Cr Accounts Payable d. Dr Inventory, Dr GST Collected, Cr Accounts Payable 8. The correct series of actions in MYOB to record the cash purchase of office supplies would be: a. Purchases - Pay Bills b. Banking - Spend Money c. Accounts - Record Journal Entry d. Banking - Enter Purchases 9. After navigating to the Purchases command centre and then selecting Pay Bills, MYOB allows users to record the following transactions: a. Purchases on credit b. Cash receipts from suppliers c. Cash payments made to suppliers d. None of the above 10. When inventory purchased on credit is returned to a supplier because it is damaged it is necessary to: a. Prepare a bill for the number of the items returned as a negative quantities b. Match a negative bill against the supplier's outstanding balance c. Reduce stock on hand to write off the damaged stock d. Both a and b e. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts