Question: Q1 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!! MV Pfd Corporation has debt with a coupon rate of 5% and a yield to

Q1 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!!

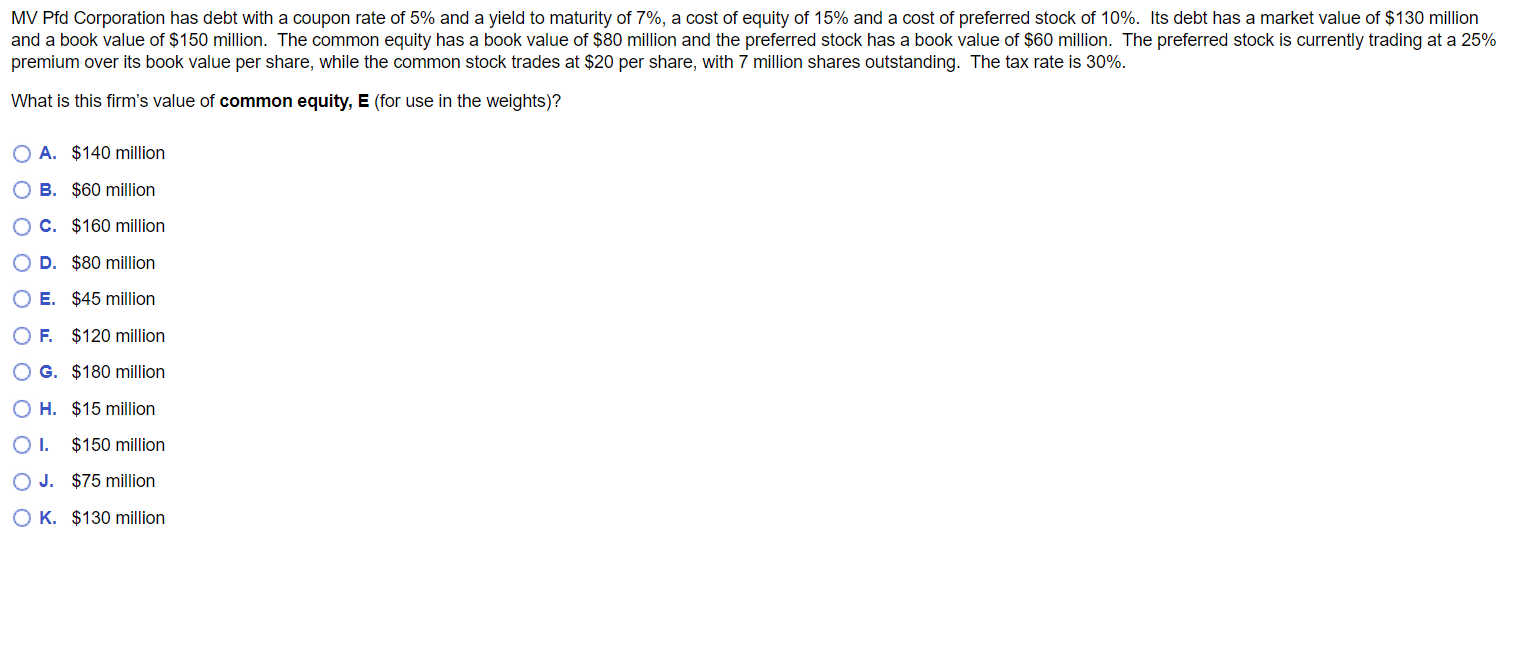

MV Pfd Corporation has debt with a coupon rate of 5% and a yield to maturity of 7%, a cost of equity of 15% and a cost of preferred stock of 10%. Its debt has a market value of $130 million and a book value of $150 million. The common equity has a book value of $80 million and the preferred stock has a book value of $60 million. The preferred stock is currently trading at a 25% premium over its book value per share, while the common stock trades at $20 per share, with 7 million shares outstanding. The tax rate is 30%. What is this firm's value of common equity, E (for use in the weights)? A. $140 million B. $60 million C. $160 million D. $80 million E. $45 million F. $120 million G. $180 million H. $15 million I. \$150 million J. $75 million K. $130 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts