Question: Q16 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!! MV Pfd Corporation has debt with a coupon rate of 5% and a yield to

Q16 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!!

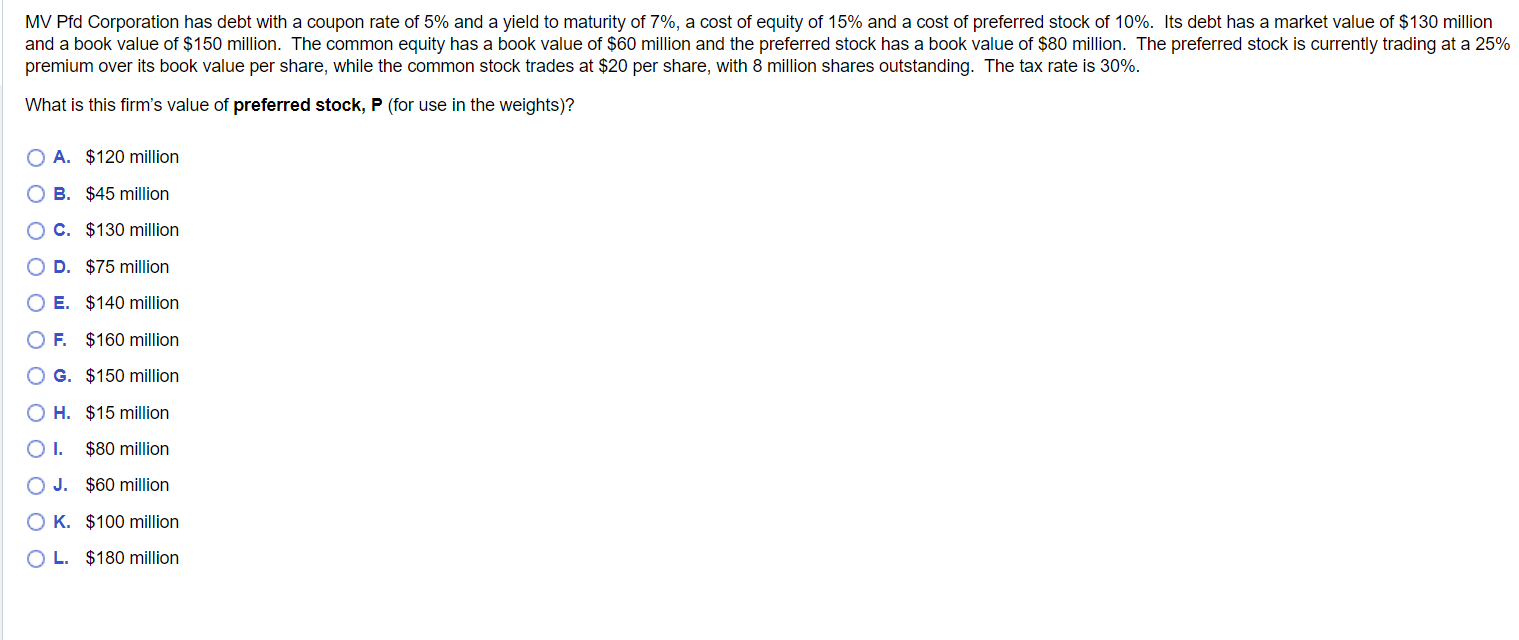

MV Pfd Corporation has debt with a coupon rate of 5% and a yield to maturity of 7%, a cost of equity of 15% and a cost of preferred stock of 10%. Its debt has a market value of $130 million and a book value of $150 million. The common equity has a book value of $60 million and the preferred stock has a book value of $80 million. The preferred stock is currently trading at a 25% premium over its book value per share, while the common stock trades at $20 per share, with 8 million shares outstanding. The tax rate is 30%. What is this firm's value of preferred stock, P (for use in the weights)? A. $120 million B. $45 million C. $130 million D. $75 million E. $140 million F. $160 million G. $150 million H. $15 million I. $80 million J. $60 million K. $100 million L. $180 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts