Question: Q11. Let's estimate the required return for PFE. Here are the historic returns for various asset classes. Step one is to calculate the historic rates

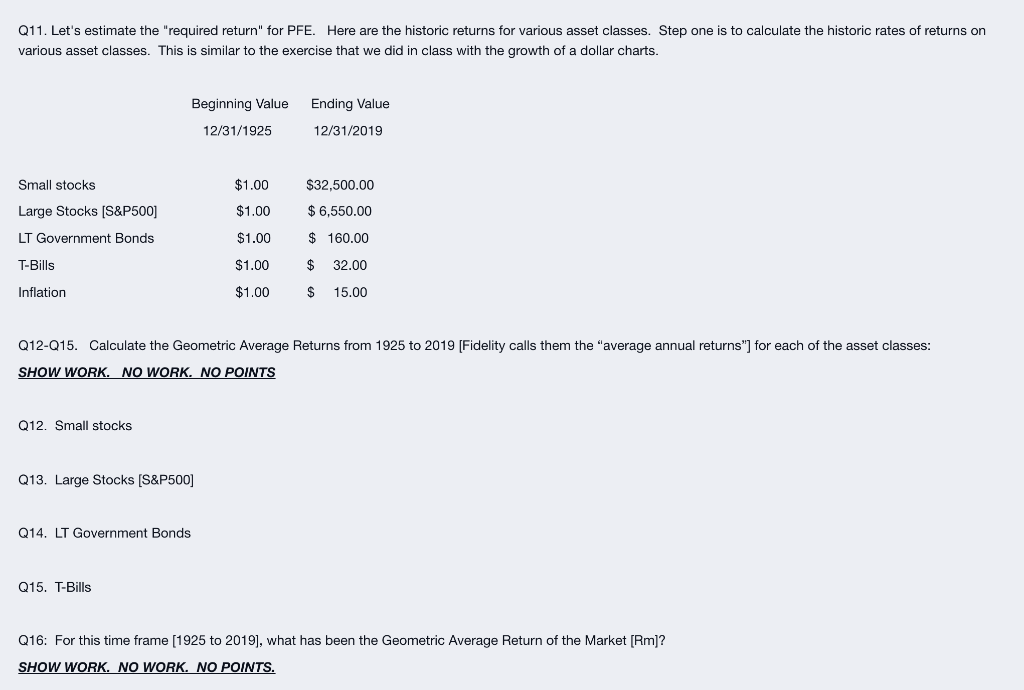

Q11. Let's estimate the "required return" for PFE. Here are the historic returns for various asset classes. Step one is to calculate the historic rates of returns on various asset classes. This is similar to the exercise that we did in class with the growth of a dollar charts. Beginning Value Ending Value 12/31/2019 12/31/1925 $1.00 $32,500.00 Small stocks Large Stocks (S&P500] LT Government Bonds $1.00 $ 6,550.00 $1.00 $ 160.00 T-Bills $1.00 $ 32.00 Inflation $1.00 $ 15.00 Q12-Q15. Calculate the Geometric Average Returns from 1925 to 2019 [Fidelity calls them the "average annual returns") for each of the asset classes: SHOW WORK. NO WORK. NO POINTS Q12. Small stocks Q13. Large Stocks (S&P500] Q14. LT Government Bonds Q15. T-Bills Q16: For this time frame (1925 to 2019), what has been the Geometric Average Return of the Market [Rm]? SHOW WORK. NO WORK. NO POINTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts