Question: Q19 & 20. steps to solve and answer please 19. On August 1, a portfolio manager has a bond portfolio worth $10 million. The duration

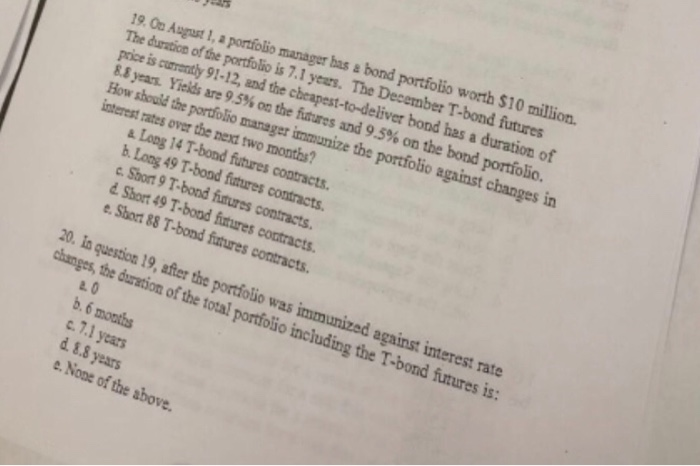

19. On August 1, a portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio is 7.1 years. The December T-bond futures price is currently 91-12, and the cheapest-to-deliver bond has a duration of 8.8 years. Yields are 9.5% on the futures and 9.5% on the bond portfolio. How should the portfolio manager immunize the portfolio against changes in interest rates over the next two months? Long 14 T-bond futures contracts. b. Long 49 T-bond futures contracts. c. Short 9 T-bond fixtures contracts. Short 49 T-bood fixtures contracts e. Short 88 T-bond futures contracts. 20. In question 19, after the portfolio was immunized against interest rate changes, the duration of the total portfolio including the T-bond futures is: 20 b. 6 months c. 7.1 years d. 8.8 years e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts