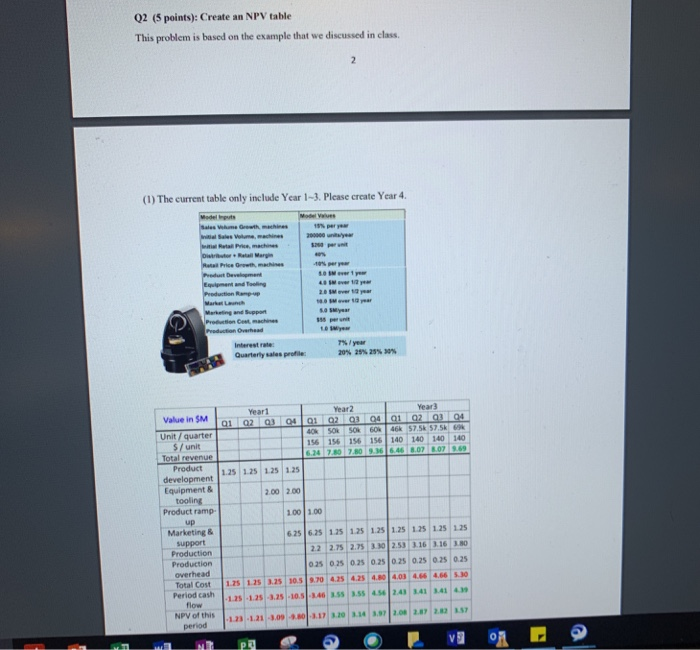

Question: Q2 (5 points): Create an NPV table This problem is based on the example that we discussed in class. (1) The current table only include

Q2 (5 points): Create an NPV table This problem is based on the example that we discussed in class. (1) The current table only include Year 1-3. Please create Year 4. Modelleputs Sales Wohne Growth m ines 200000 tari, machines Dior Retail Mary Real Price Othman Prevement Equipment and Tooling Production Rump up Swerty 40 vety 20 over 10 year Marketing and Support Production et machines Production Overhead 5. Syar 3 p Interest rate Quarterly sales profile 7%/year 20% 25% 2530% Year2 Year 01 02 03 04 01 02 03 04 01 02 03 04 40 SOR SOR 60X462 57.5k 57.5 156 156 156 156 140 140 140 140 614 7 7 9 116.66 807 0 989 125 125 1.25 Value in SM Unit / quarter $ / unit Total revenue Product development Equipment & tooling Product ramp- up Marketing & support Production Production overhead 625 6.25 1.25 1.25 1.25 1.25 125 125 125 22 2.75 2.75 3.30 2.53 2.46 3.16 3.80 0.23 0.23 0.23 0.23 0.23 0.23 0.25 0.25 1.25 1.23 2.25 10.5 1.70 2.25 1.25 4.80 4.00 4.50 4.60 .30 -1.25 -1.25 3.25 30 35 285 286 24 MAI 1.2 1.213.09.2017 3.10.14 Period cash flow NPV of this period MEL Q2 (5 points): Create an NPV table This problem is based on the example that we discussed in class. (1) The current table only include Year 1-3. Please create Year 4. Modelleputs Sales Wohne Growth m ines 200000 tari, machines Dior Retail Mary Real Price Othman Prevement Equipment and Tooling Production Rump up Swerty 40 vety 20 over 10 year Marketing and Support Production et machines Production Overhead 5. Syar 3 p Interest rate Quarterly sales profile 7%/year 20% 25% 2530% Year2 Year 01 02 03 04 01 02 03 04 01 02 03 04 40 SOR SOR 60X462 57.5k 57.5 156 156 156 156 140 140 140 140 614 7 7 9 116.66 807 0 989 125 125 1.25 Value in SM Unit / quarter $ / unit Total revenue Product development Equipment & tooling Product ramp- up Marketing & support Production Production overhead 625 6.25 1.25 1.25 1.25 1.25 125 125 125 22 2.75 2.75 3.30 2.53 2.46 3.16 3.80 0.23 0.23 0.23 0.23 0.23 0.23 0.25 0.25 1.25 1.23 2.25 10.5 1.70 2.25 1.25 4.80 4.00 4.50 4.60 .30 -1.25 -1.25 3.25 30 35 285 286 24 MAI 1.2 1.213.09.2017 3.10.14 Period cash flow NPV of this period MEL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts