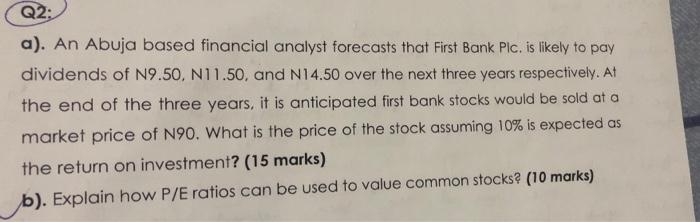

Question: Q2: a). An Abuja based financial analyst forecasts that First Bank Plc. is likely to pay dividends of N9.50, N11.50, and N14.50 over the next

Q2: a). An Abuja based financial analyst forecasts that First Bank Plc. is likely to pay dividends of N9.50, N11.50, and N14.50 over the next three years respectively. At the end of the three years, it is anticipated first bank stocks would be sold at a market price of N90. What is the price of the stock assuming 10% is expected as the return on investment? (15 marks) b). Explain how P/E ratios can be used to value common stocks? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock