Question: Q2 a. ZF Ltd. has a security B 1.4, expected market return is 16%, risk free rate is 9%, Company's anticipated dividend for the

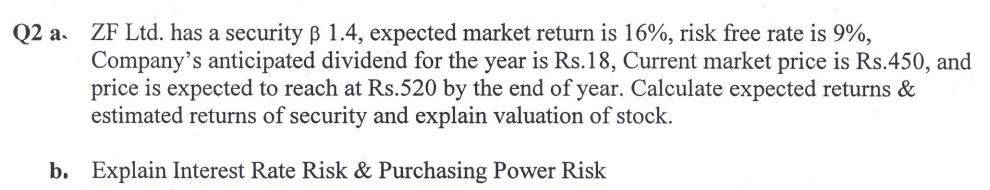

Q2 a. ZF Ltd. has a security B 1.4, expected market return is 16%, risk free rate is 9%, Company's anticipated dividend for the year is Rs.18, Current market price is Rs.450, and price is expected to reach at Rs.520 by the end of year. Calculate expected returns & estimated returns of security and explain valuation of stock. b. Explain Interest Rate Risk & Purchasing Power Risk

Step by Step Solution

There are 3 Steps involved in it

a To calculate the expected returns of the security we can use the capital asset pricing model CAPM Expected return Riskfree rate Beta Expected market ... View full answer

Get step-by-step solutions from verified subject matter experts