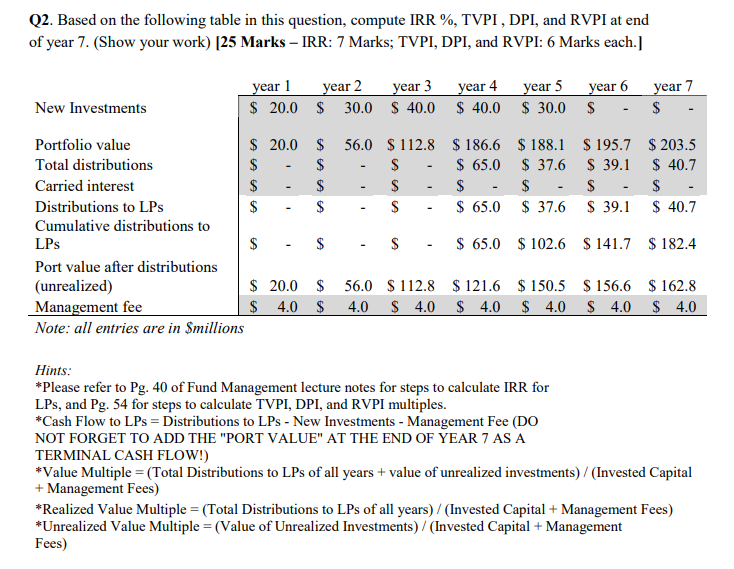

Question: Q2. Based on the following table in this question, compute IRR %, TVPI, DPI, and RVPI at end of year 7. (Show your work) (25

Q2. Based on the following table in this question, compute IRR %, TVPI, DPI, and RVPI at end of year 7. (Show your work) (25 Marks IRR: 7 Marks; TVPI, DPI, and RVPI: 6 Marks each.] year 1 year 2 year 3 year 4 year 5 year 6 year 7 New Investments $ 20.0 $ 30.0 40.0 $ 40.0 $ 30.0 $ - $ Portfolio value $ 20.0 $ 56.0 $ 112.8 $ 186.6 $ 188.1 $ 195.7 $ 203.5 Total distributions $ $ $ $ 65.0 $ 37.6 $ 39.1 $ 40.7 Carried interest $ $ $ $ $ $ - $ Distributions to LPs $ $ $ $ 65.0 $ 37.6 $ 39.1 $ 40.7 Cumulative distributions to LPs $ $ $ 65.0 $ 102.6 $ 141.7 $ 182.4 Port value after distributions (unrealized) $ 20.0 $ 56.0 $ 112.8 $ 121.6 $ 150.5 $ 156.6 $ 162.8 Management fee $ 4.0 $ 4.0 S 4.0 $ 4.0 $ 4.0 S 4.0 $ 4.0 Note: all entries are in $millions A A $ - Hints: * Please refer to Pg. 40 of Fund Management lecture notes for steps to calculate IRR for LPs, and Pg. 54 for steps to calculate TVPI, DPI, and RVPI multiples. *Cash Flow to LPs = Distributions to LPs - New Investments - Management Fee (DO NOT FORGET TO ADD THE "PORT VALUE" AT THE END OF YEAR 7 AS A TERMINAL CASH FLOW!) *Value Multiple = (Total Distributions to LPs of all years + value of unrealized investments) / (Invested Capital + Management Fees) * Realized Value Multiple = (Total Distributions to LPs of all years) / (Invested Capital + Management Fees) *Unrealized Value Multiple = (Value of Unrealized Investments) / (Invested Capital + Management Fees) Q2. Based on the following table in this question, compute IRR %, TVPI, DPI, and RVPI at end of year 7. (Show your work) (25 Marks IRR: 7 Marks; TVPI, DPI, and RVPI: 6 Marks each.] year 1 year 2 year 3 year 4 year 5 year 6 year 7 New Investments $ 20.0 $ 30.0 40.0 $ 40.0 $ 30.0 $ - $ Portfolio value $ 20.0 $ 56.0 $ 112.8 $ 186.6 $ 188.1 $ 195.7 $ 203.5 Total distributions $ $ $ $ 65.0 $ 37.6 $ 39.1 $ 40.7 Carried interest $ $ $ $ $ $ - $ Distributions to LPs $ $ $ $ 65.0 $ 37.6 $ 39.1 $ 40.7 Cumulative distributions to LPs $ $ $ 65.0 $ 102.6 $ 141.7 $ 182.4 Port value after distributions (unrealized) $ 20.0 $ 56.0 $ 112.8 $ 121.6 $ 150.5 $ 156.6 $ 162.8 Management fee $ 4.0 $ 4.0 S 4.0 $ 4.0 $ 4.0 S 4.0 $ 4.0 Note: all entries are in $millions A A $ - Hints: * Please refer to Pg. 40 of Fund Management lecture notes for steps to calculate IRR for LPs, and Pg. 54 for steps to calculate TVPI, DPI, and RVPI multiples. *Cash Flow to LPs = Distributions to LPs - New Investments - Management Fee (DO NOT FORGET TO ADD THE "PORT VALUE" AT THE END OF YEAR 7 AS A TERMINAL CASH FLOW!) *Value Multiple = (Total Distributions to LPs of all years + value of unrealized investments) / (Invested Capital + Management Fees) * Realized Value Multiple = (Total Distributions to LPs of all years) / (Invested Capital + Management Fees) *Unrealized Value Multiple = (Value of Unrealized Investments) / (Invested Capital + Management Fees)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts