Question: Q2: Mean-Variance Portfolio Optimization You are given three assets A, B, C. Expected return for three assets are 10, and 2. respectively. 2.1) Assume the

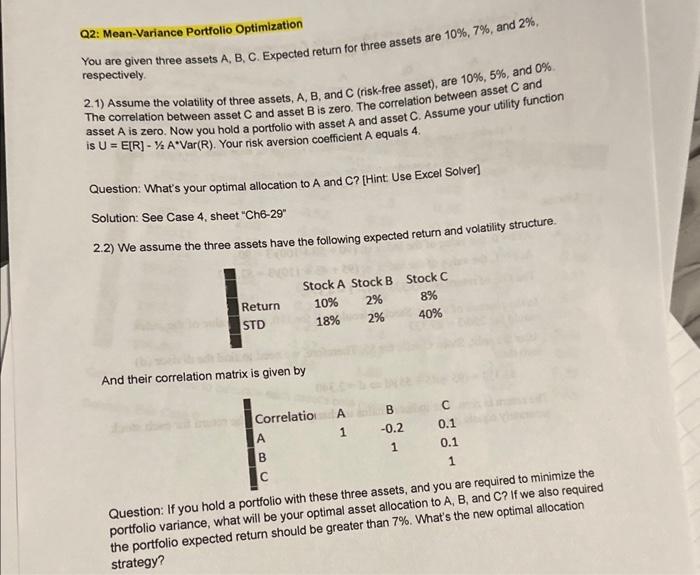

Q2: Mean-Variance Portfolio Optimization You are given three assets A, B, C. Expected return for three assets are \10, and \2. respectively. 2.1) Assume the volatility of three assets, \\( A, B \\), and \\( C \\) (risk-free asset), are \10, and \0 The correlation between asset \\( C \\) and asset \\( B \\) is zero. The correlation between asset \\( C \\) and asset \\( A \\) is zero. Now you hold a portfolio with asset \\( A \\) and asset \\( C \\). Assume your utility function is \\( U=E[R]-1 / 2 A^{*} \\operatorname{Var}(R) \\). Your risk aversion coefficient \\( A \\) equals 4. Question: What's your optimal allocation to A and C? [Hint: Use Excel Solver] Solution: See Case 4, sheet \"Ch6-29\" 2.2) We assume the three assets have the following expected return and volatility structure And their correlation matrix is given by Question: If you hold a portfolio with these three assets, airm, 3quired to minimize the portfolio variance, what will be your optimal asset allocation to \\( A, B \\), and \\( C \\) ? If we also required the portfolio expected retum should be greater than \7. What's the new optimal allocation strategy? Q2: Mean-Variance Portfolio Optimization You are given three assets A, B, C. Expected return for three assets are \10, and \2. respectively. 2.1) Assume the volatility of three assets, \\( A, B \\), and \\( C \\) (risk-free asset), are \10, and \0 The correlation between asset \\( C \\) and asset \\( B \\) is zero. The correlation between asset \\( C \\) and asset \\( A \\) is zero. Now you hold a portfolio with asset \\( A \\) and asset \\( C \\). Assume your utility function is \\( U=E[R]-1 / 2 A^{*} \\operatorname{Var}(R) \\). Your risk aversion coefficient \\( A \\) equals 4. Question: What's your optimal allocation to A and C? [Hint: Use Excel Solver] Solution: See Case 4, sheet \"Ch6-29\" 2.2) We assume the three assets have the following expected return and volatility structure And their correlation matrix is given by Question: If you hold a portfolio with these three assets, airm, 3quired to minimize the portfolio variance, what will be your optimal asset allocation to \\( A, B \\), and \\( C \\) ? If we also required the portfolio expected retum should be greater than \7. What's the new optimal allocation strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts