Question: You are given three assets A, B, C. Expected return for three assets are 10%, 7%, and 2%, respectively. 2.1) Assume the volatility of three

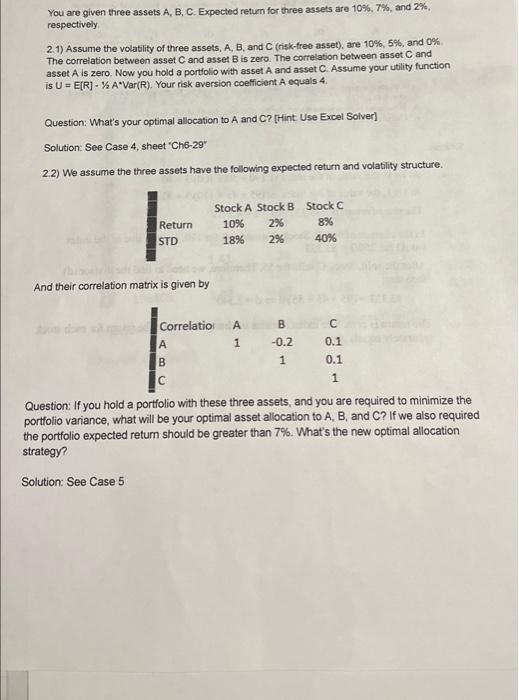

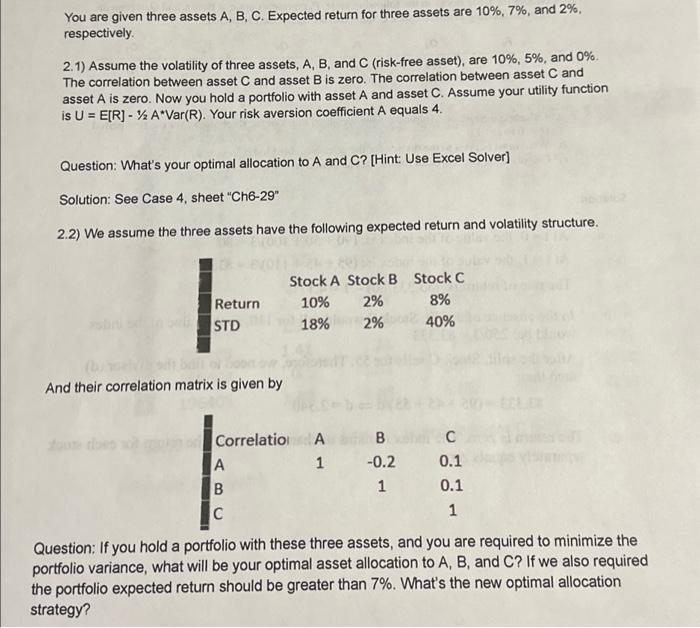

You are given three assets A, B, C. Expected return for three assets are \10, and \2. respectively 2.1) Assume the volatility of three assets, A, B, and C (risk-free asset), are \10, and \0 The correlation between asset \\( C \\) and asset \\( B \\) is zero. The correlation between asset \\( C \\) and asset \\( A \\) is zero. Now you hold a portfolio with asset \\( A \\) and asset \\( C \\). Assume your utility function is \\( U=E[R]-1 / 2 A^{*} \\operatorname{Var}(R) \\). Your risk aversion coefficient \\( A \\) equals 4 . Question: What's your optimal allocation to A and C? [Hint. Use Excel Solver] Solution: See Case 4, sheet \"Ch6-29\" 2.2) We assume the three assets have the following expected return and volatility structure. And their correlation matrix is given by Question: If you hold a portfolio with these three assets, and you are required to minimize the portfolio variance, what will be your optimal asset allocation to \\( A, B \\), and \\( C \\) ? If we also required the portfolio expected retum should be greater than \7. What's the new optimal allocation strategy? You are given three assets A, B, C. Expected return for three assets are \10, and \2, respectively. 2.1) Assume the volatility of three assets, \\( A, B \\), and \\( C \\) (risk-free asset), are \10, and \0. The correlation between asset \\( C \\) and asset \\( B \\) is zero. The correlation between asset \\( C \\) and asset \\( A \\) is zero. Now you hold a portfolio with asset \\( A \\) and asset \\( C \\). Assume your utility function is \\( U=E[R]-1 / 2 A * \\operatorname{Var}(R) \\). Your risk aversion coefficient \\( A \\) equals 4. Question: What's your optimal allocation to A and C? [Hint: Use Excel Solver] Solution: See Case 4, sheet \"Ch6-29\" 2.2) We assume the three assets have the following expected return and volatility structure. And their correlation matrix is given by Question: If you hold a portfolio with these three assets, and you are required to minimize the portfolio variance, what will be your optimal asset allocation to \\( A, B \\), and \\( C \\) ? If we also required the portfolio expected return should be greater than \7. What's the new optimal allocation strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts