Question: Q2. Please show all steps to make the question worth any marks Meursault Energy Inc. completed construction of a nuclear power plant on January 1,

Q2. Please show all steps to make the question worth any marks

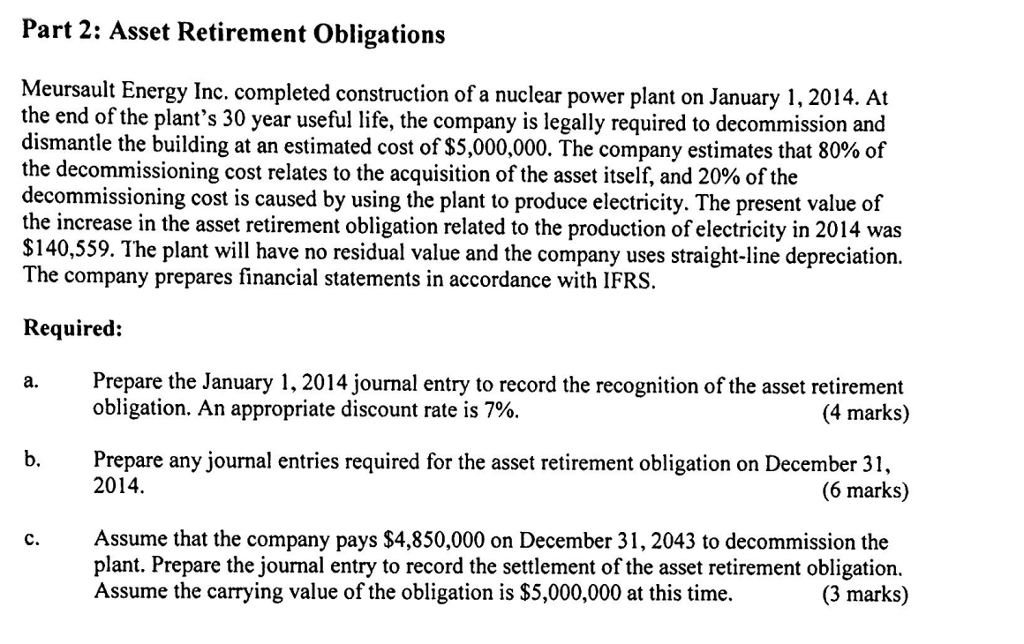

Meursault Energy Inc. completed construction of a nuclear power plant on January 1, 2014. At the end of the plant's 30 year useful life, the company is legally required to decommission and dismantle the building at an estimated cost of $5,000,000. The company estimates that 80% of the decommissioning cost relates to the acquisition of the asset itself, and 20% of the decommissioning cost is caused by using the plant to produce electricity. The present value of the increase in the asset retirement obligation related to the production of electricity in 2014 was $140, 559. The plant will have no residual value and the company uses straight-line depreciation. The company prepares financial statements in accordance with IFRS. Required: a. Prepare the January 1, 2014 journal entry to record the recognition of the asset retirement obligation. An appropriate discount rate is 7%. b. Prepare any journal entries required for the asset retirement obligation on December 31 2014. c. Assume that the company pays $4, 850,000 on December 31, 2043 to decommission the plant. Prepare the journal entry to record the settlement of the asset retirement obligation. Assume the carrying value of the obligation is $5,000,000 at this time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts