Question: Q21 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!! A university endowment fund is tax-exempt, whereas many, if not most, of the contributors to

Q21 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!!

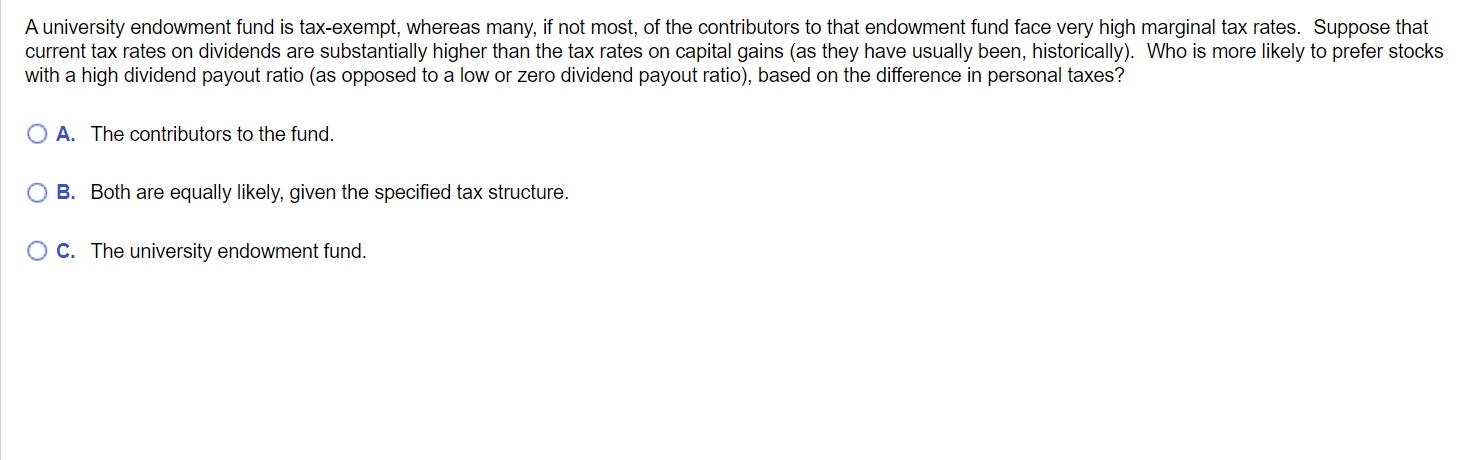

A university endowment fund is tax-exempt, whereas many, if not most, of the contributors to that endowment fund face very high marginal tax rates. Suppose that current tax rates on dividends are substantially higher than the tax rates on capital gains (as they have usually been, historically). Who is more likely to prefer stocks with a high dividend payout ratio (as opposed to a low or zero dividend payout ratio), based on the difference in personal taxes? A. The contributors to the fund. B. Both are equally likely, given the specified tax structure. C. The university endowment fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts