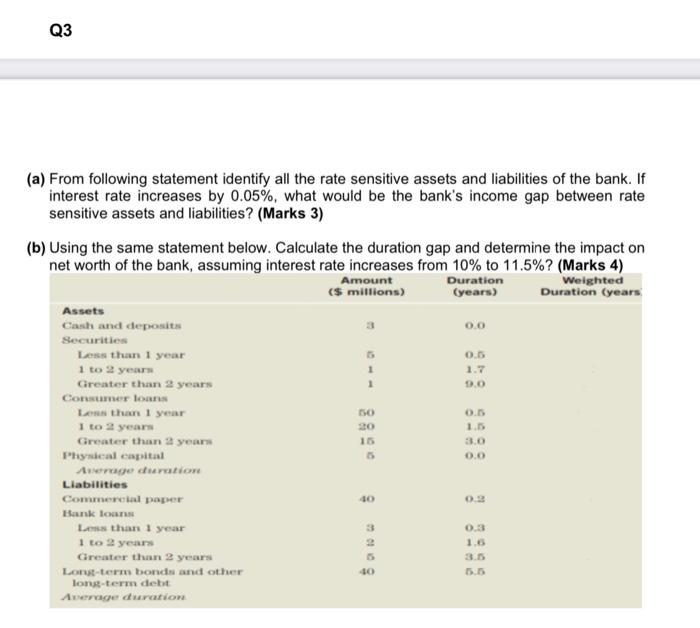

Question: Q3 (a) From following statement identify all the rate sensitive assets and liabilities of the bank. If interest rate increases by 0.05%, what would be

Q3 (a) From following statement identify all the rate sensitive assets and liabilities of the bank. If interest rate increases by 0.05%, what would be the bank's income gap between rate sensitive assets and liabilities? (Marks 3) (b) Using the same statement below. Calculate the duration gap and determine the impact on net worth of the bank, assuming interest rate increases from 10% to 11.5%? (Marks 4) Weighted Duration (years Amount ($ millions) Duration (years) Assets 3 0.0 Cash and deposit Securities Less than 1 year 0.5 1 to 2 years 1 1.7 1 1.0 Greater than 2 years Consumer loans Los than 1 year 1 to 2 years Greater than years Physical capital A curatione 20 1.5 3.0 0.0 Liabilities 03 3 Commercial paper Hank loan Le than 1 year 1 to 2 years Greater than 2 years Long-term bonds and other long-term debt Are duration 8 10 8 Q3 (a) From following statement identify all the rate sensitive assets and liabilities of the bank. If interest rate increases by 0.05%, what would be the bank's income gap between rate sensitive assets and liabilities? (Marks 3) (b) Using the same statement below. Calculate the duration gap and determine the impact on net worth of the bank, assuming interest rate increases from 10% to 11.5%? (Marks 4) Weighted Duration (years Amount ($ millions) Duration (years) Assets 3 0.0 Cash and deposit Securities Less than 1 year 0.5 1 to 2 years 1 1.7 1 1.0 Greater than 2 years Consumer loans Los than 1 year 1 to 2 years Greater than years Physical capital A curatione 20 1.5 3.0 0.0 Liabilities 03 3 Commercial paper Hank loan Le than 1 year 1 to 2 years Greater than 2 years Long-term bonds and other long-term debt Are duration 8 10 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts