Question: Q3 and Q4 with work please here is the rest of information needed for 4 b) What is each project's IRR? c) If you were

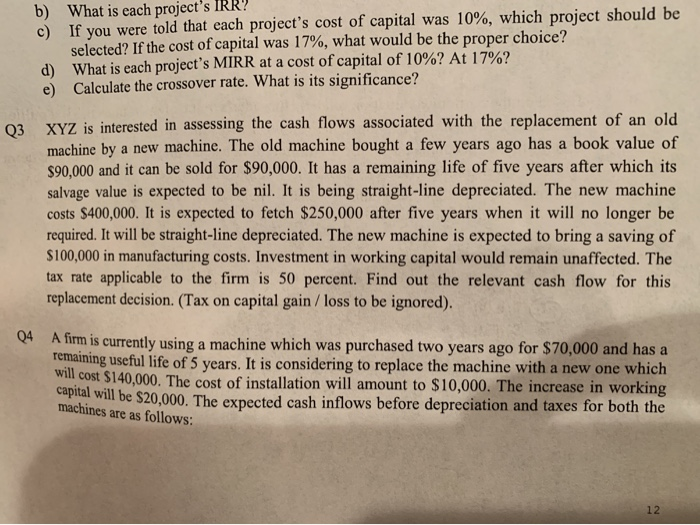

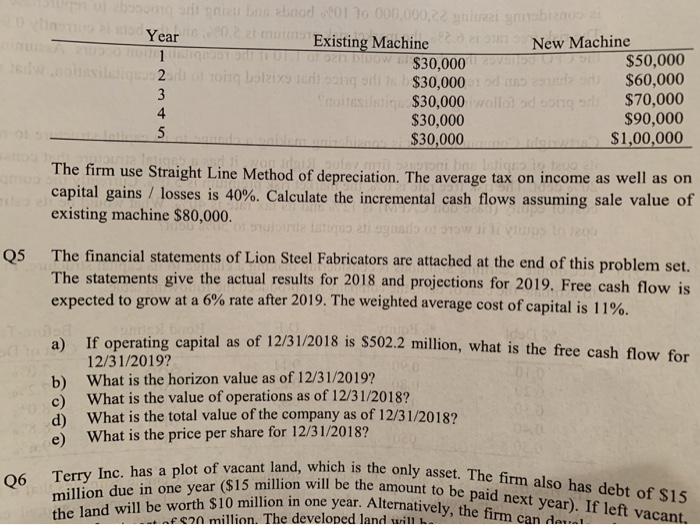

b) What is each project's IRR? c) If you were told that each project's cost of capital was 10%, which project should be selected? If the cost of capital was 17%, what would be the proper choice? d) What is each project's MIRR at a cost of capital of 10%? At 17%? e) Calculate the crossover rate. What is its significance? Q3 XYZ is interested in assessing the cash flows associated with the replacement of an old machine by a new machine. The old machine bought a few years ago has a book value of $90,000 and it can be sold for $90,000. It has a remaining life of five years after which its salvage value is expected to be nil. It is being straight-line depreciated. The new machine costs $400,000. It is expected to fetch $250,000 after five years when it will no longer be required. It will be straight-line depreciated. The new machine is expected to bring a saving of $100,000 in manufacturing costs. Investment in working capital would remain unaffected. The tax rate applicable to the firm is 50 percent. Find out the relevant cash flow for this replacement decision. (Tax on capital gain/loss to be ignored). Q4 A firm is currently using a machine which was remaining useful life of 5 years. It is considering to replace the machine with a new one which will cost $140,000. The cost of installation will amount to $10,000. The increase in working capital will be $20,000. The expected cash inflows before depreciation and taxes for both the purchased two years ago for $70, 000 and has a machines are as follows: 12 o bo s nie bns ebnod 01 To 000,000,22 pniuzzi snobi200 ti eloYearc0.22 mu Existing Machine New Machine S $50,000 $60,000 $70,000 $90,000 $1,00,000 $30,000 vns soig odi s $30,0000t od ms e .cosiltiq2 g bolzixe ie 3 Scotesitiqu $30,000ollol d cong or $30,000 4 o anog t aoniam aning.i $30,000m doina Straight Line Method of depreciation. The average tax on income as well as on use capital gains/ losses is 40%. Calculate the incremental cash flows assuming sale value of existing machine $80,000 nuon ltiq ati ognado ot w idivps to te0 The financial statements of Lion Steel Fabricators are attached at the end of this problem set. Q5 The statements give the actual results for 2018 and projections for 2019. Free cash flow is expected to grow at a 6% rate after 2019. The weighted average cost of capital is 11% ioa) If operating capital as of 12/31/2018 is $502.2 million, what is the free cash flow for 12/31/2019? What is the horizon value as of 12/31/2019? b) What is the value of operations c) d) What is the total value of the company as of 12/31/2018? What is the price per share for 12/31/2018? as of 12/31/2018? e) Terry Inc. has a plot of vacant land, which is the only asset. The firm also has debt of $15 the land will be worth $10 million in one year. Alternatively, the firm can del million due in one year ($15 million will be the amount to be paid next year). If left vacant. Q6 f s2n million. The developed land wilL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts