Question: Q3 Please answer the question clearly step by step, if there is a handwritten answer on paper, write it so it can be viewed clearly.

Q3

Please answer the question clearly step by step, if there is a handwritten answer on paper, write it so it can be viewed clearly.

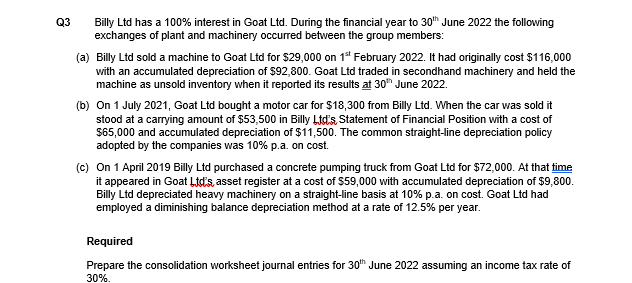

Billy Ltd has a 100% interest in Goat Ltd. During the financial year to 30th June 2022 the following exchanges of plant and machinery occurred between the group members: (a) Billy Ltd sold a machine to Goat Ltd for $29,000 on 1st February 2022. It had originally cost $116,000 with an accumulated depreciation of $92,800. Goat Ltd traded in secondhand machinery and held the machine as unsold inventory when it reported its results at 30th June 2022. (b) On 1 July 2021, Goat Ltd bought a motor car for $18,300 from Billy Ltd. When the car was sold it stood at a carrying amount of $53,500 in Billy Ltd's Statement of Financial Position with a cost of $65,000 and accumulated depreciation of $11,500. The common straight-line depreciation policy adopted by the companies was 10% p.a. on cost. (c) On 1 April 2019 Billy Ltd purchased a concrete pumping truck from Goat Ltd for $72,000. At that time it appeared in Goat Ltd's asset register at a cost of $59,000 with accumulated depreciation of $9,800. Billy Ltd depreciated heavy machinery on a straight-line basis at 10% p.a. on cost. Goat Ltd had employed a diminishing balance depreciation method at a rate of 12.5% per year. Required Prepare the consolidation worksheet journal entries for 30th June 2022 assuming an income tax rate of 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts