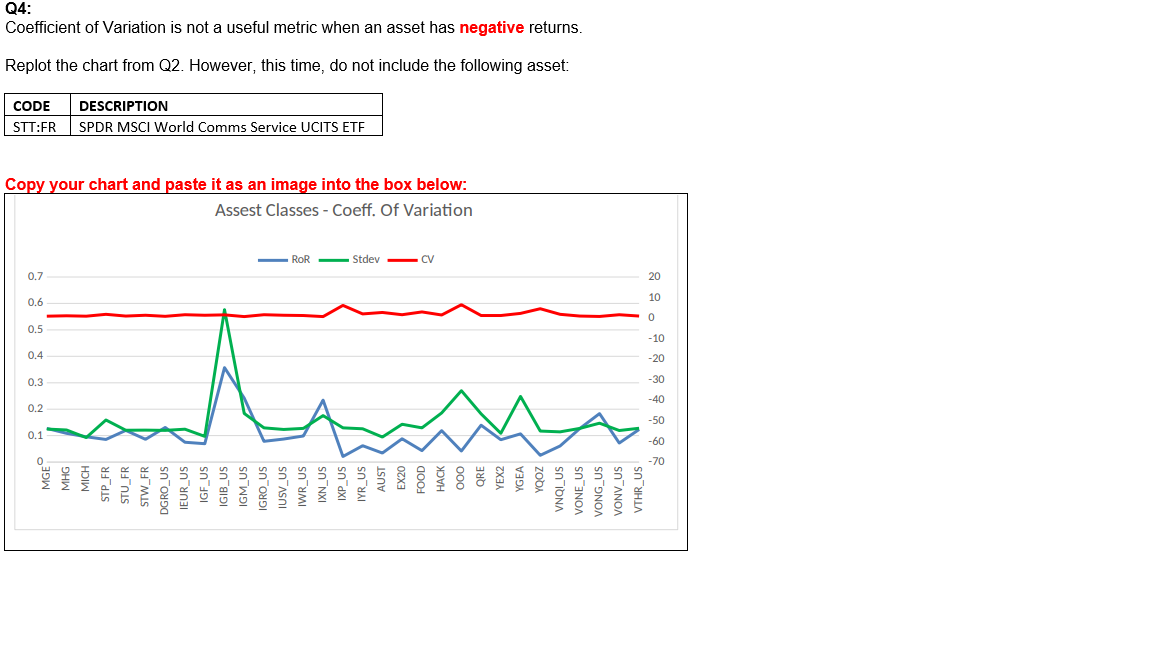

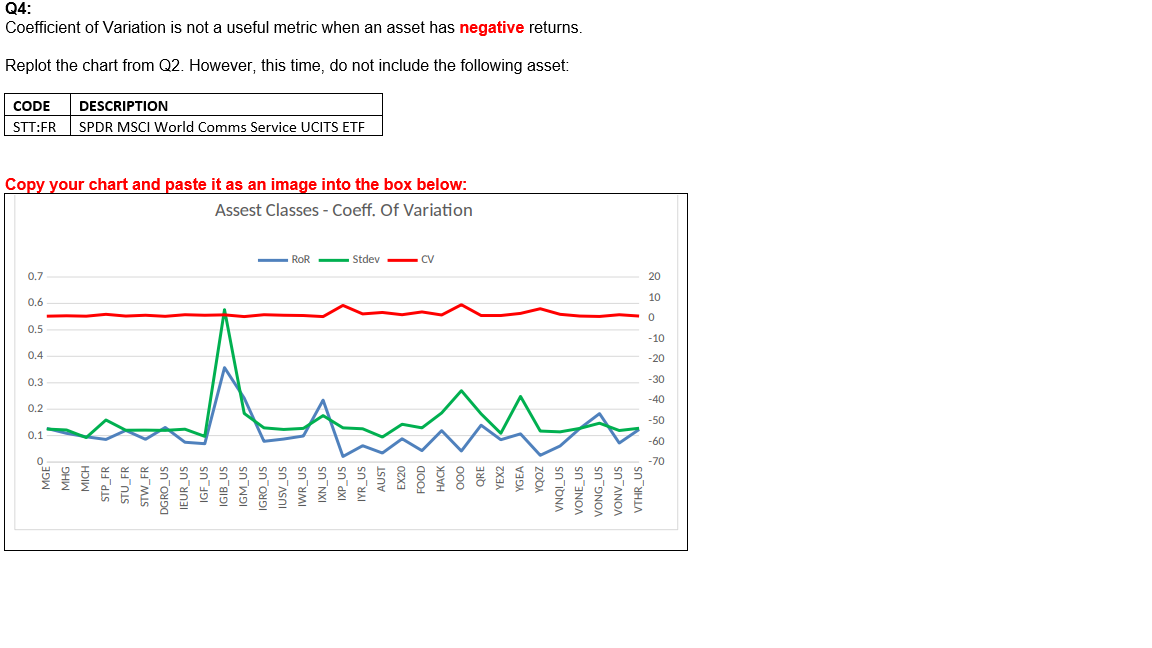

Question: Q4: CODE 0.1 0.5 0.2 0.4 0.6 0.3 0.7 STT:FR MGF MHG MICH STP_FR STU_FR DESCRIPTION STW_FR DGRO_US IEUR_US IGF_US IGIB_US SPDR MSCI World Comms

Q4: CODE 0.1 0.5 0.2 0.4 0.6 0.3 0.7 STT:FR MGF MHG MICH STP_FR STU_FR DESCRIPTION STW_FR DGRO_US IEUR_US IGF_US IGIB_US SPDR MSCI World Comms Service UCITS ETF Copy your chart and paste it as an image into the box below: IGM_US IGRO_US IUSV_US Replot the chart from Q2. However, this time, do not include the following asset: Coefficient of Variation is not a useful metric when an asset has negative returns. ROR IWR_US IXN_US IXP_US Assest Classes - Coeff. Of Variation IYR_US AUST Stdev CV EX20 FOOD HACK QRE YEX2 YGEA YQOZ VNQI_US VONE_US VONG_US VONV_US VTHR_US 8 -10 O 20 10 -70 -30 -20 -50 -40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts