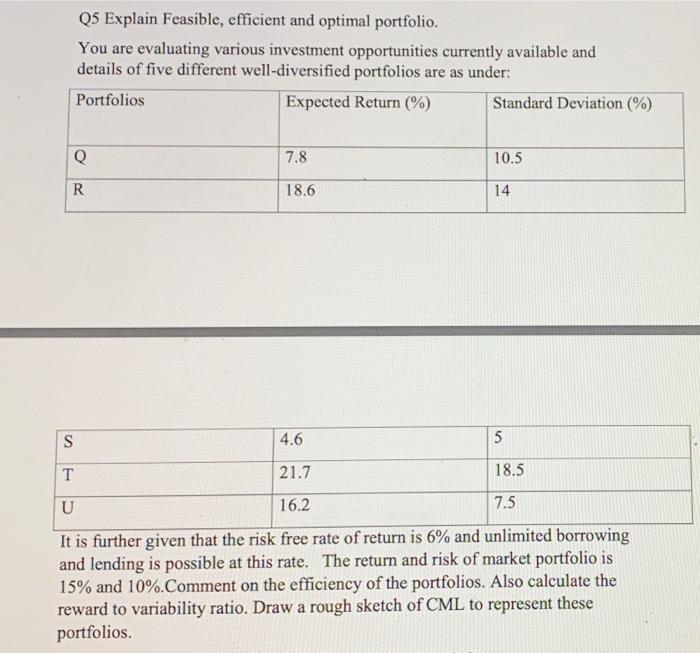

Question: Q5 Explain Feasible, efficient and optimal portfolio. You are evaluating various investment opportunities currently available and details of five different well-diversified portfolios are as under:

Q5 Explain Feasible, efficient and optimal portfolio. You are evaluating various investment opportunities currently available and details of five different well-diversified portfolios are as under: Portfolios Expected Return (%) Standard Deviation (%) Q 7.8 10.5 R 18.6 14 S 4.6 5 T 21.7 18.5 U 16.2 7.5 It is further given that the risk free rate of return is 6% and unlimited borrowing and lending is possible at this rate. The return and risk of market portfolio is 15% and 10%.Comment on the efficiency of the portfolios. Also calculate the reward to variability ratio. Draw a rough sketch of CML to represent these portfolios. Q5 Explain Feasible, efficient and optimal portfolio. You are evaluating various investment opportunities currently available and details of five different well-diversified portfolios are as under: Portfolios Expected Return (%) Standard Deviation (%) Q 7.8 10.5 R 18.6 14 S 4.6 5 T 21.7 18.5 U 16.2 7.5 It is further given that the risk free rate of return is 6% and unlimited borrowing and lending is possible at this rate. The return and risk of market portfolio is 15% and 10%.Comment on the efficiency of the portfolios. Also calculate the reward to variability ratio. Draw a rough sketch of CML to represent these portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts