Question: q5 please notice how a has minor question within. please answer all will leave good review Innovation Company is thinking about marketing a new software

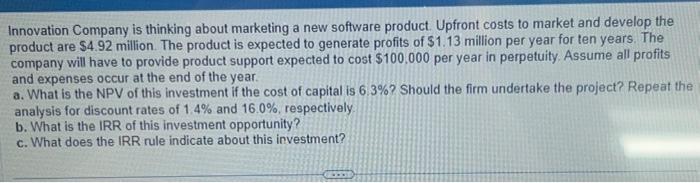

Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.92 million. The product is expected to generate profits of $1.13 million per year for ten years. The company will have to provide product support expected to cost $100.000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 6.3% ? Should the firm undertake the project? Repeat the analysis for discount rates of 1.4% and 16.0%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts