Question: Q7 A/B 7. A) How does an increase in diversification of assets modify the riskiness of a portfolio? B) Using the diagram below, with a

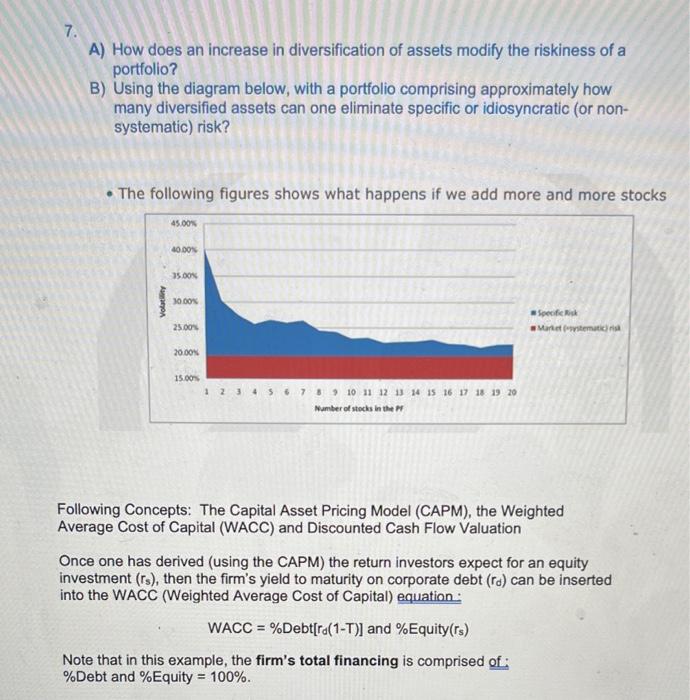

7. A) How does an increase in diversification of assets modify the riskiness of a portfolio? B) Using the diagram below, with a portfolio comprising approximately how many diversified assets can one eliminate specific or idiosyncratic (or nonsystematic) risk? - The following figures shows what happens if we add more and more stocks Following Concepts: The Capital Asset Pricing Model (CAPM), the Weighted Average Cost of Capital (WACC) and Discounted Cash Flow Valuation Once one has derived (using the CAPM) the return investors expect for an equity investment (rs), then the firm's yield to maturity on corporate debt (rd) can be inserted into the WACC (Weighted Average Cost of Capital) equation: WACC=%Debt[rad(1T)]and%Equity(rs) Note that in this example, the firm's total financing is comprised of: % Debt and % Equity =100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts