Question: Q7 ) What is the repricing gap? In using this model to evaluate interest rate risk, what is meant by rate sensitivity? On what financial

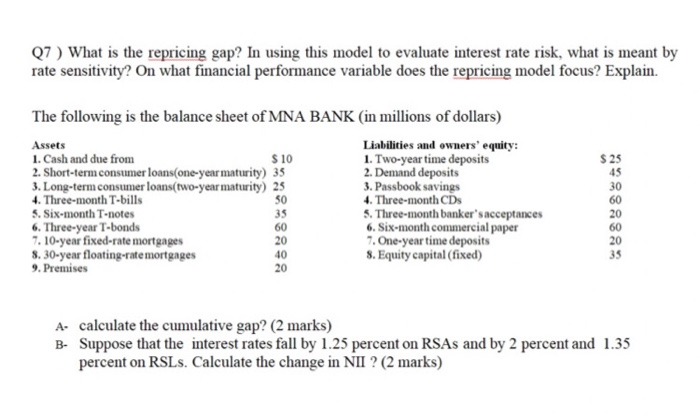

Q7 ) What is the repricing gap? In using this model to evaluate interest rate risk, what is meant by rate sensitivity? On what financial performance variable does the repricing model focus? Explain. The following is the balance sheet of MNA BANK (in millions of dollars) Assets Liabilities and owners' equity: 1. Cash and due from $ 10 1. Two-year time deposits 2. Short-term consumer loans one-year maturity) 35 2. Demand deposits 3. Long-term consumer loans(two-year maturity) 25 3. Passbook savings 4. Three-month T-bills 50 4. Three-month CDS 5. Six-month T-notes 35 5. Three-month banker's acceptances 6. Three-year T-bonds 60 6. Six-month commercial paper 7.10-year fixed-rate mortgages 20 7. One-year time deposits 8. 30-year floating-rate mortgages 40 8. Equity capital (fixed) 9. Premises 20 $ 25 45 30 60 20 60 20 35 A- calculate the cumulative gap? (2 marks) B- Suppose that the interest rates fall by 1.25 percent on RSAs and by 2 percent and 1.35 percent on RSLs. Calculate the change in NII ? (2 marks) Q7 ) What is the repricing gap? In using this model to evaluate interest rate risk, what is meant by rate sensitivity? On what financial performance variable does the repricing model focus? Explain. The following is the balance sheet of MNA BANK (in millions of dollars) Assets Liabilities and owners' equity: 1. Cash and due from $ 10 1. Two-year time deposits 2. Short-term consumer loans one-year maturity) 35 2. Demand deposits 3. Long-term consumer loans(two-year maturity) 25 3. Passbook savings 4. Three-month T-bills 50 4. Three-month CDS 5. Six-month T-notes 35 5. Three-month banker's acceptances 6. Three-year T-bonds 60 6. Six-month commercial paper 7.10-year fixed-rate mortgages 20 7. One-year time deposits 8. 30-year floating-rate mortgages 40 8. Equity capital (fixed) 9. Premises 20 $ 25 45 30 60 20 60 20 35 A- calculate the cumulative gap? (2 marks) B- Suppose that the interest rates fall by 1.25 percent on RSAs and by 2 percent and 1.35 percent on RSLs. Calculate the change in NII ? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts