Question: Q8 (20 points) Consider a setting with multiple deviations from perfect capital markets. In particular: There are taxes on the corporate profits, at a

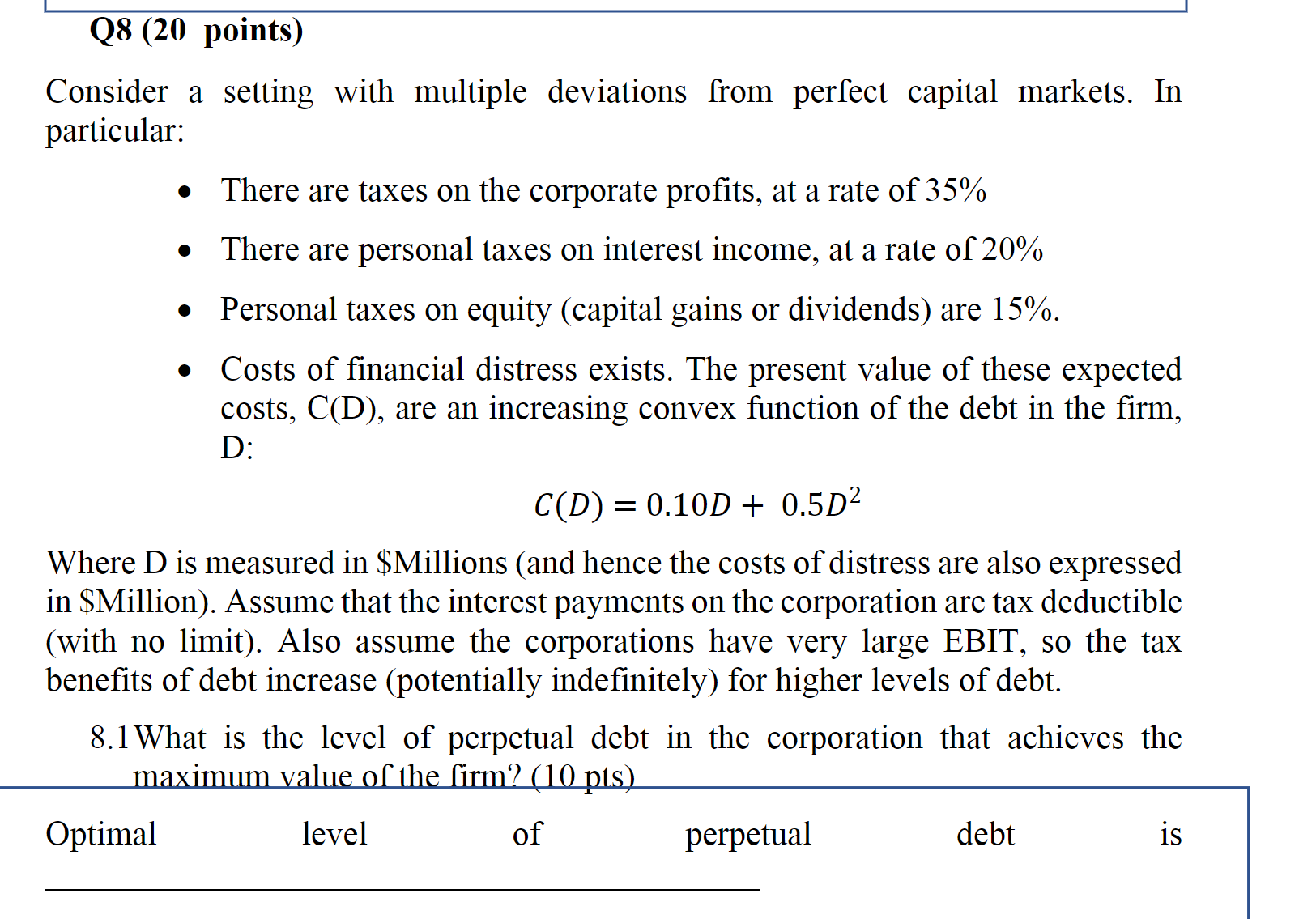

Q8 (20 points) Consider a setting with multiple deviations from perfect capital markets. In particular: There are taxes on the corporate profits, at a rate of 35% There are personal taxes on interest income, at rate of 20% Personal taxes on equity (capital gains or dividends) are 15%. Costs of financial distress exists. The present value of these expected costs, C(D), are an increasing convex function of the debt in the firm, D: C(D) = 0.10D + 0.5D Where D is measured in $Millions (and hence the costs of distress are also expressed in $Million). Assume that the interest payments on the corporation are tax deductible (with no limit). Also assume the corporations have very large EBIT, so the tax benefits of debt increase (potentially indefinitely) for higher levels of debt. 8.1 What is the level of perpetual debt in the corporation that achieves the maximum value of the firm? (10 pts) Optimal level of perpetual debt is S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts