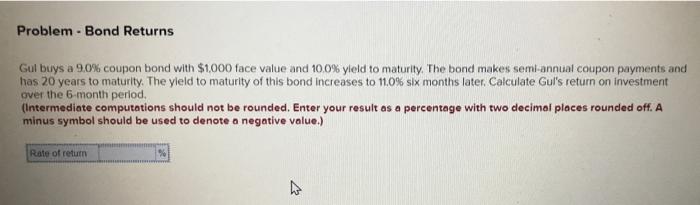

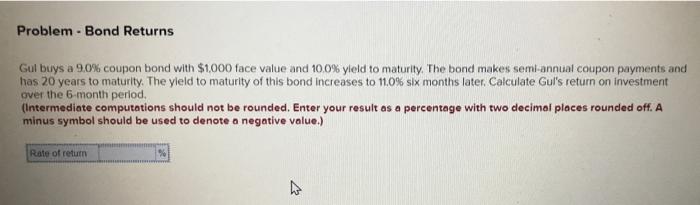

Question: Q.IV) Problem - Bond Returns Gul buys a 9.0% coupon bond with $1.000 face value and 100% yleld to maturity. The bond makes semi-annual coupon

Q.IV)

Problem - Bond Returns Gul buys a 9.0% coupon bond with $1.000 face value and 100% yleld to maturity. The bond makes semi-annual coupon payments and has 20 years to maturity. The yield to maturity of this bond increases to 11.0% six months later. Calculate Gul's return on investment over the 6-month period, (Intermediate computations should not be rounded. Enter your result as a percentage with two decimal places rounded off. A minus symbol should be used to denote a negative value.) Rate of return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock