Question: QS 3 - 1 1 ( Algo ) Adjusting for unearned ( deferred ) revenues LO P 2 3 points table [ [ eBook

QS Algo Adjusting for unearned deferred revenues LO P

points

tableeBookHintPrintReferences

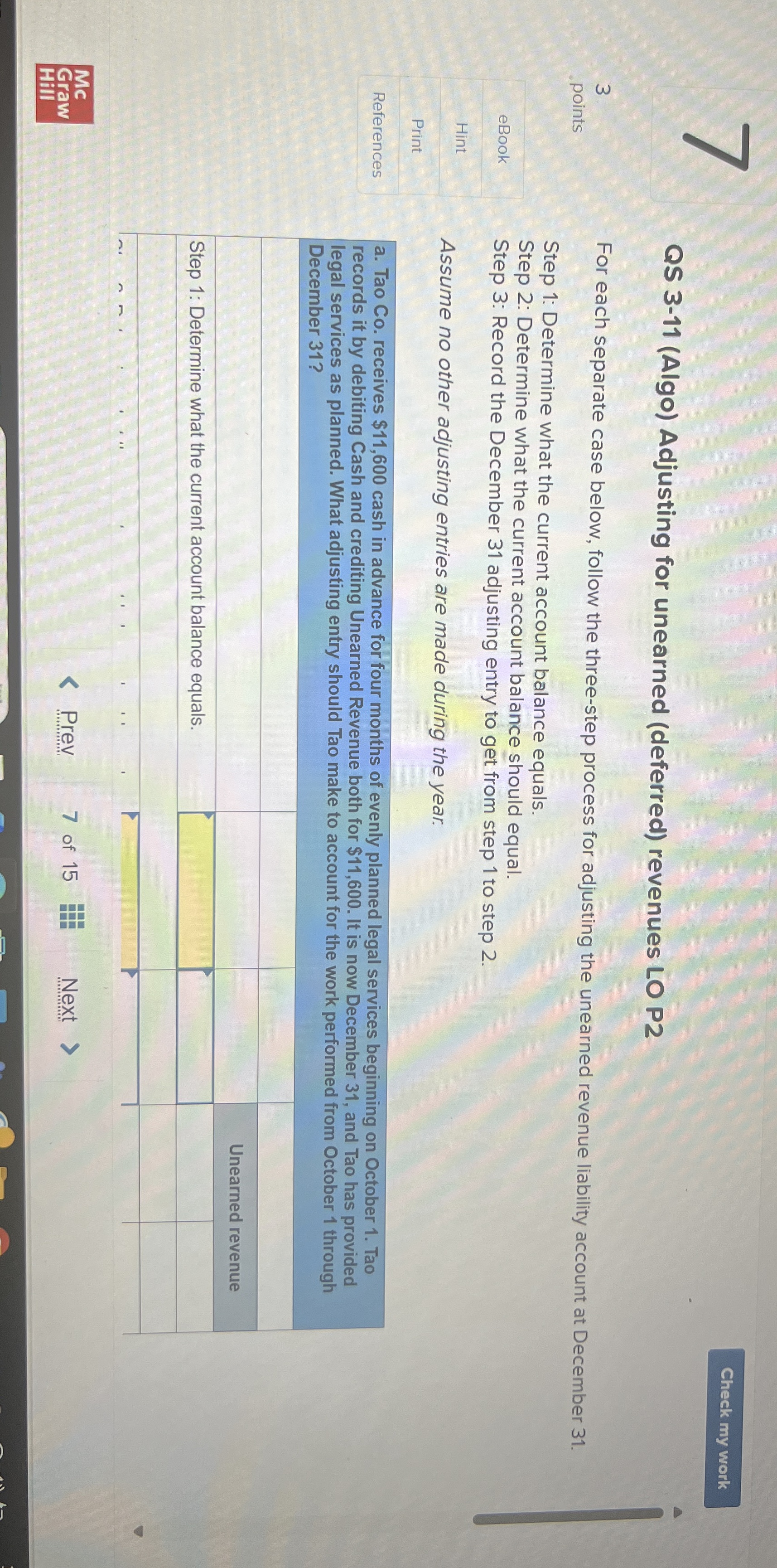

For each separate case below, follow the threestep process for adjusting the unearned revenue liability account at December

Step : Determine what the current account balance equals.

Step : Determine what the current account balance should equal.

Step : Record the December adjusting entry to get from step to step

Assume no other adjusting entries are made during the year.

a Tao Co receives $ cash in advance for four months of evenly planned legal services beginning on October Tao records it by debiting Cash and crediting Unearned Revenue both for $ It is now December and Tao has provided legal services as planned. What adjusting entry should Tao make to account for the work performed from October through December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock