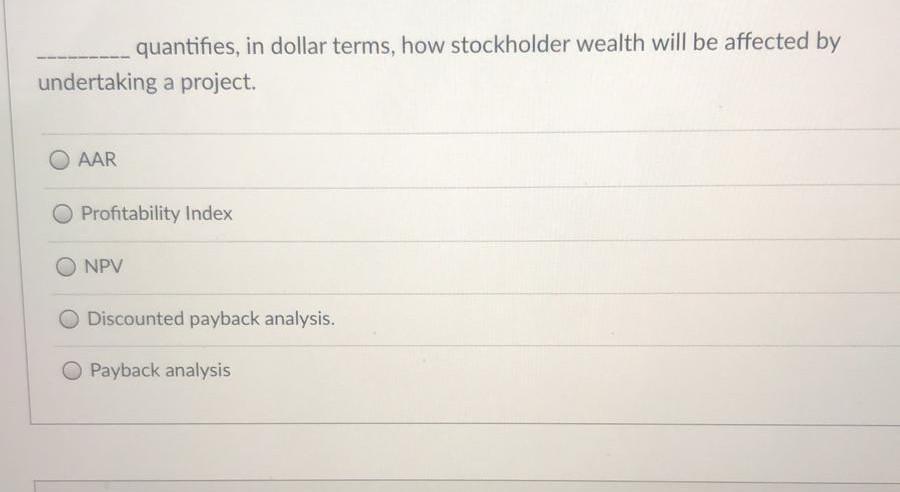

Question: quantifies, in dollar terms, how stockholder wealth will be affected by undertaking a project. O AAR O Profitability Index NPV O Discounted payback analysis. O

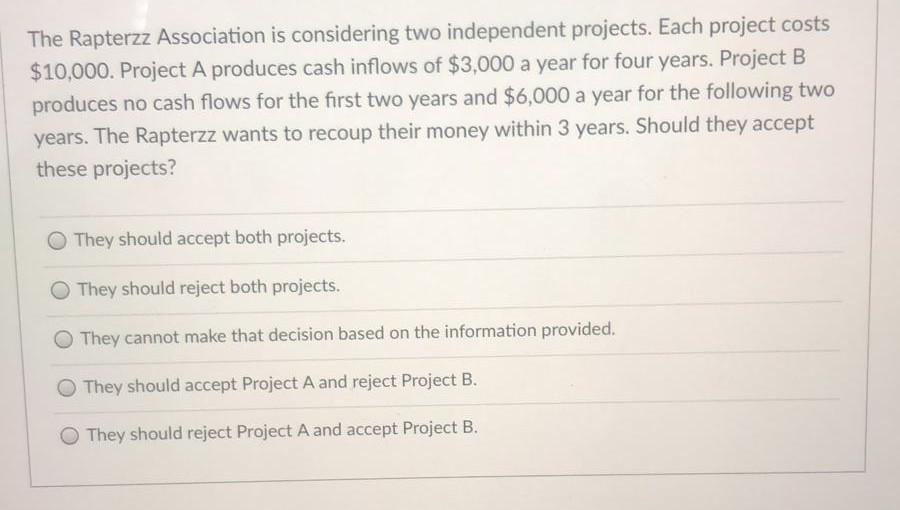

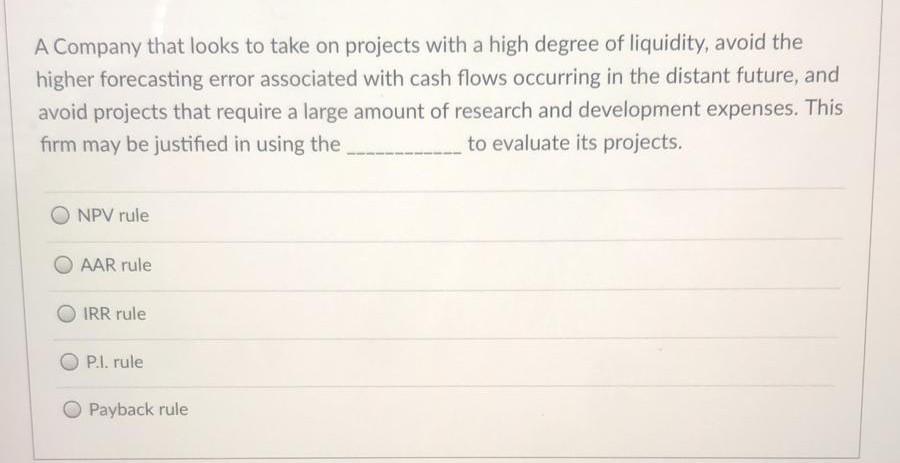

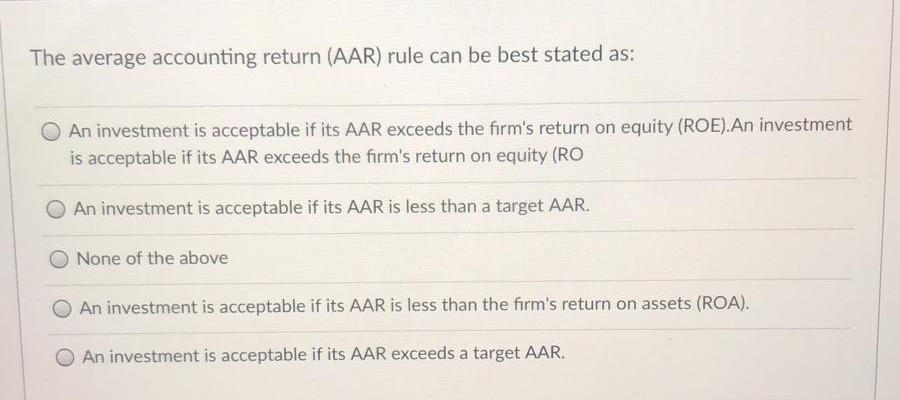

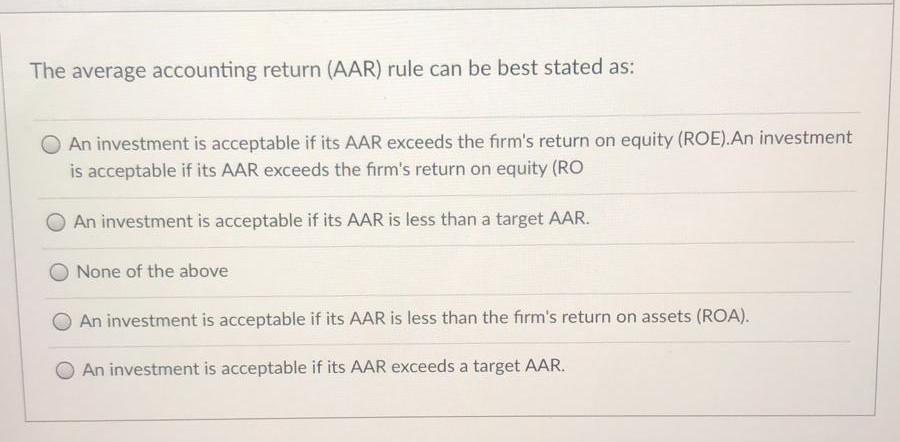

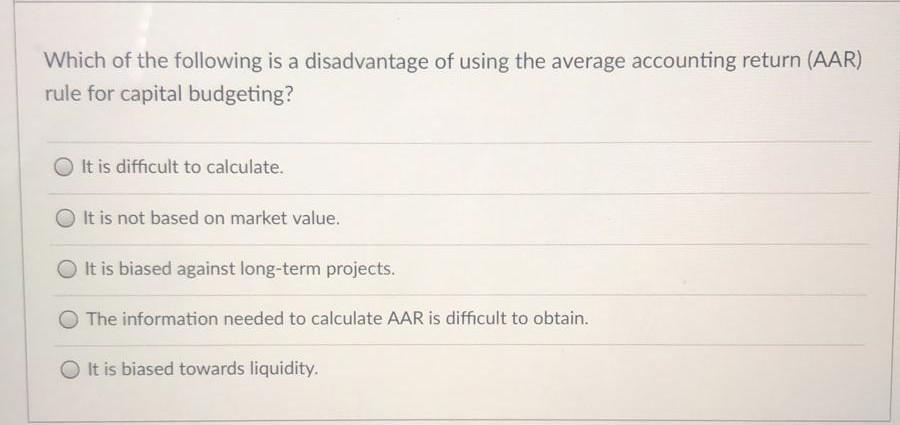

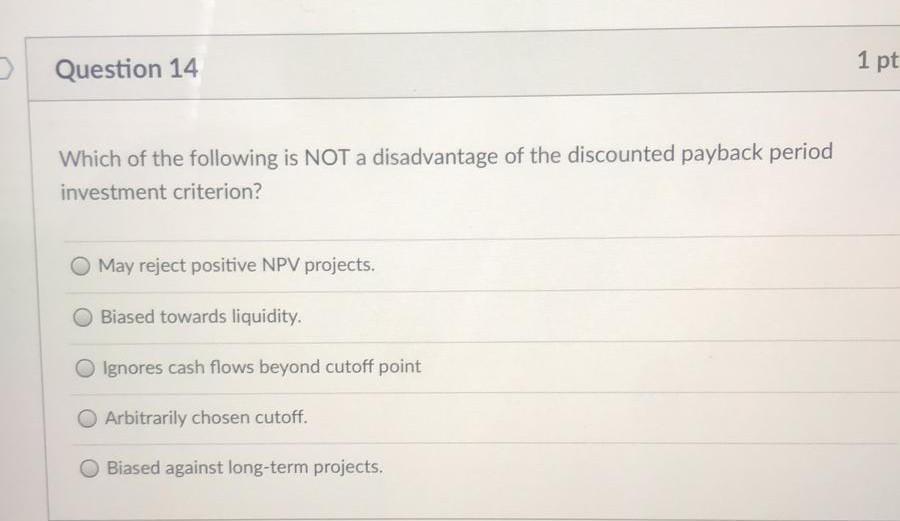

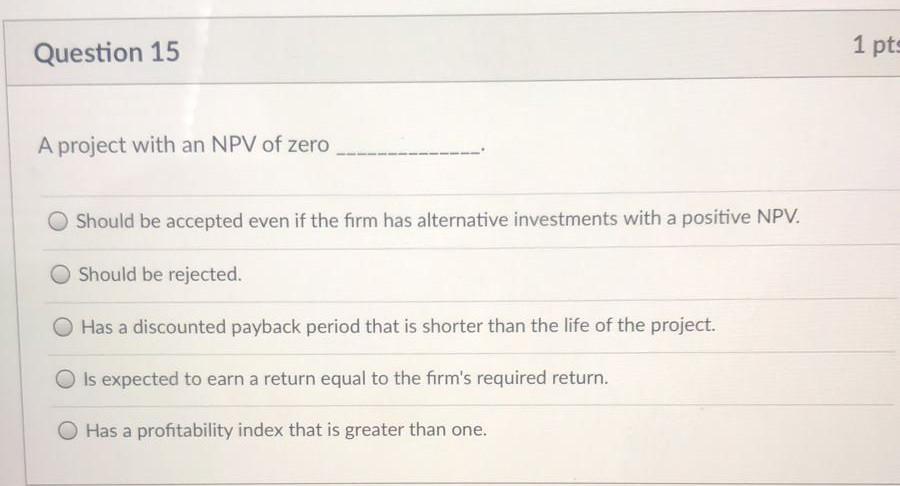

quantifies, in dollar terms, how stockholder wealth will be affected by undertaking a project. O AAR O Profitability Index NPV O Discounted payback analysis. O Payback analysis The Rapterzz Association is considering two independent projects. Each project costs $10,000. Project A produces cash inflows of $3,000 a year for four years. Project B produces no cash flows for the first two years and $6,000 a year for the following two years. The Rapterzz wants to recoup their money within 3 years. Should they accept these projects? They should accept both projects. They should reject both projects. They cannot make that decision based on the information provided. They should accept Project A and reject Project B. They should reject Project A and accept Project B. A Company that looks to take on projects with a high degree of liquidity, avoid the higher forecasting error associated with cash flows occurring in the distant future, and avoid projects that require a large amount of research and development expenses. This firm may be justified in using the to evaluate its projects. NPV rule AAR rule IRR rule O Pl.rule Payback rule The average accounting return (AAR) rule can be best stated as: An investment is acceptable if its AAR exceeds the firm's return on equity (ROE).An investment is acceptable if its AAR exceeds the firm's return on equity (RO An investment is acceptable if its AAR is less than a target AAR. None of the above An investment is acceptable if its AAR is less than the firm's return on assets (ROA). An investment is acceptable if its AAR exceeds a target AAR. The average accounting return (AAR) rule can be best stated as: An investment is acceptable if its AAR exceeds the firm's return on equity (ROE).An investment is acceptable if its AAR exceeds the firm's return on equity (RO An investment is acceptable if its AAR is less than a target AAR. None of the above An investment is acceptable if its AAR is less than the firm's return on assets (ROA). An investment is acceptable if its AAR exceeds a target AAR. Which of the following is a disadvantage of using the average accounting return (AAR) rule for capital budgeting? It is difficult to calculate. It is not based on market value. O It is biased against long-term projects. The information needed to calculate AAR is difficult to obtain. It is biased towards liquidity. 1 pt Question 14 Which of the following is NOT a disadvantage of the discounted payback period investment criterion? O May reject positive NPV projects. O Biased towards liquidity. O Ignores cash flows beyond cutoff point O Arbitrarily chosen cutoff. Biased against long-term projects. Question 15 1 pts A project with an NPV of zero O Should be accepted even if the firm has alternative investments with a positive NPV. Should be rejected. Has a discounted payback period that is shorter than the life of the project. O is expected to earn a return equal to the firm's required return. O Has a profitability index that is greater than one

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock