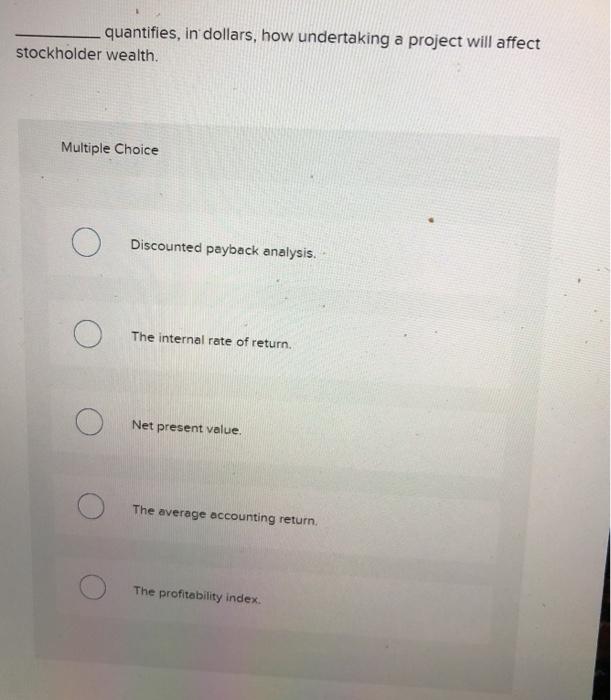

Question: quantifies, in dollars, how undertaking a project will affect stockholder wealth. Multiple Choice Discounted payback analysis. The internal rate of return Net present value O

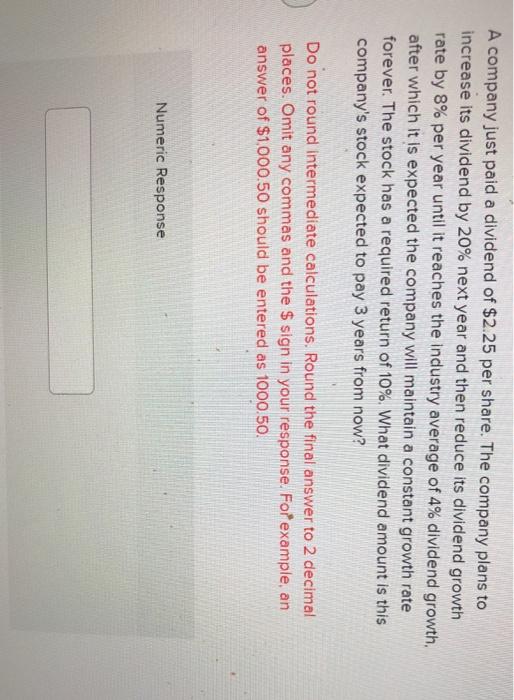

quantifies, in dollars, how undertaking a project will affect stockholder wealth. Multiple Choice Discounted payback analysis. The internal rate of return Net present value O The average accounting return. The profitability index A company just paid a dividend of $2.25 per share. The company plans to increase its dividend by 20% next year and then reduce its dividend growth rate by 8% per year until it reaches the industry average of 4% dividend growth after which it is expected the company will maintain a constant growth rate forever. The stock has a required return of 10%. What dividend amount is this company's stock expected to pay 3 years from now? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1.000.50 should be entered as 1000.50. Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts