Question: Quantitative Analysis for Managers Consider The Futures Position on page 40 and 41. Create an Influence Diagram for the decision of whether or not a

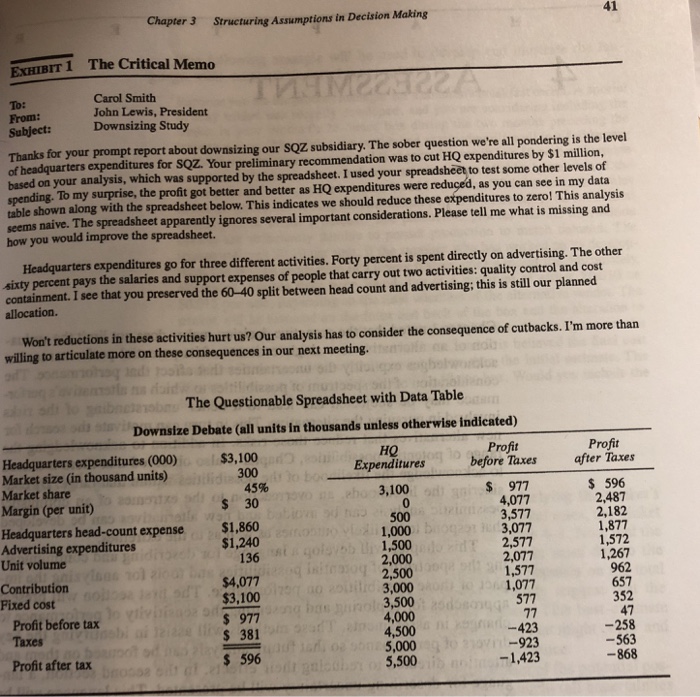

The Futures Position Smith's work was interrupted when she was handed a short in her new project. The note described the client's proes contract on planting time, the client (in agribusiness) was consideringer of bushels of corn his corn crop. More specifically, he would choose the nun as he saw it. At siness) was considering a futures on time for a set price of (which might be 0) to sell for future delivery at harvest ceeded the amount $3.10, which would be received at harvest time. If his crop e he had sold forward for future delivery, the excess wo exceede price when the harvest came in. Conversely, if he pro t harvest forward, he would buy the shortfall at the prevailing price he had decid produced less than he s gh ed to plant acreage that would produce 100,000 bushels of corn in an hly uncertain. His average year, the exact number of bushels produced was hig objectiv manage the risk. e was to maximize profit before tax, and his particular concern was to Smith knew that this analysis would also be based on a spreadsheet that she would construct. "This seems like a relatively simple problem-how much anal ysis could it take?" she commented under her breath. This time, however, she would be careful; she would present the basic assumptions of her spreadsheet to the client, then collect some data, build the spreadsheet, and then do the analysis. The place to start was to think about the decision quantity, a performance mea- sure for comparing alternatives, and intermediate quantities necessary to tie the two together. The Futures Position Smith's work was interrupted when she was handed a short in her new project. The note described the client's proes contract on planting time, the client (in agribusiness) was consideringer of bushels of corn his corn crop. More specifically, he would choose the nun as he saw it. At siness) was considering a futures on time for a set price of (which might be 0) to sell for future delivery at harvest ceeded the amount $3.10, which would be received at harvest time. If his crop e he had sold forward for future delivery, the excess wo exceede price when the harvest came in. Conversely, if he pro t harvest forward, he would buy the shortfall at the prevailing price he had decid produced less than he s gh ed to plant acreage that would produce 100,000 bushels of corn in an hly uncertain. His average year, the exact number of bushels produced was hig objectiv manage the risk. e was to maximize profit before tax, and his particular concern was to Smith knew that this analysis would also be based on a spreadsheet that she would construct. "This seems like a relatively simple problem-how much anal ysis could it take?" she commented under her breath. This time, however, she would be careful; she would present the basic assumptions of her spreadsheet to the client, then collect some data, build the spreadsheet, and then do the analysis. The place to start was to think about the decision quantity, a performance mea- sure for comparing alternatives, and intermediate quantities necessary to tie the two together

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts