Question: Quantitative Methods and Data Analysis II Chapter 6: Applications in Marketing, Finance and Management (10 marks) Question 2 (10 marks) The Top Investment Corporation is

Quantitative Methods and Data Analysis II Chapter 6: Applications in Marketing, Finance and Management (10 marks)

Quantitative Methods and Data Analysis II Chapter 6: Applications in Marketing, Finance and Management (10 marks)

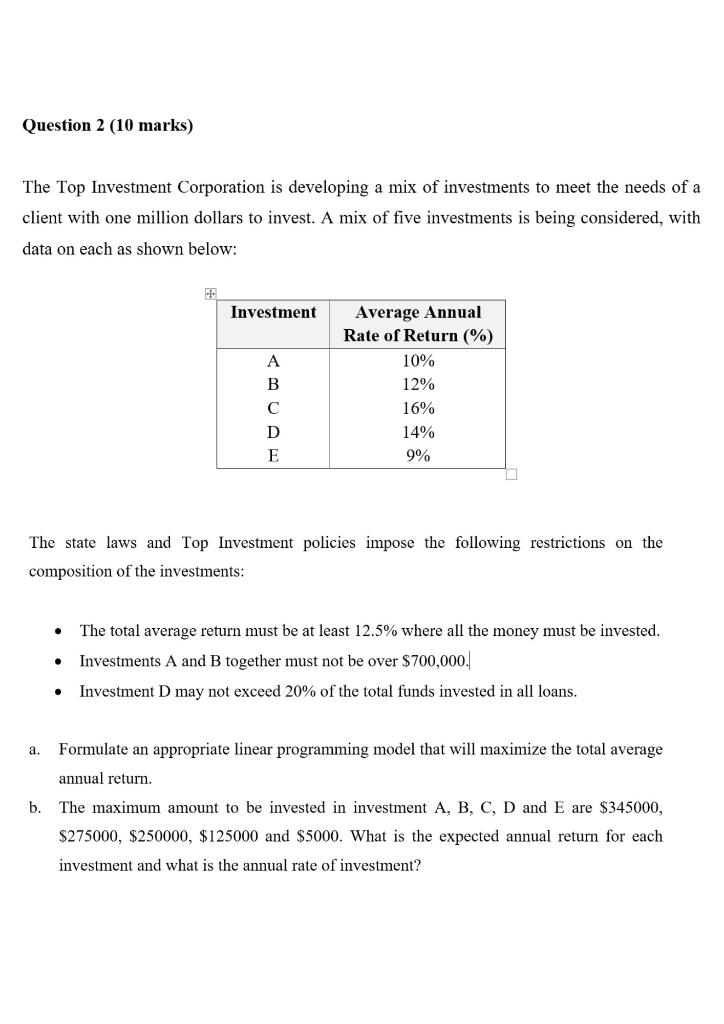

Question 2 (10 marks) The Top Investment Corporation is developing a mix of investments to meet the needs of a client with one million dollars to invest. A mix of five investments is being considered, with data on each as shown below: Investment A B D E Average Annual Rate of Return (%) 10% 12% 16% 14% 9% The state laws and Top Investment policies impose the following restrictions on the composition of the investments: . . The total average return must be at least 12.5% where all the money must be invested. Investments A and B together must not be over $700,000. Investment D may not exceed 20% of the total funds invested in all loans. a. b. Formulate an appropriate linear programming model that will maximize the total average annual return. The maximum amount to be invested in investment A, B, C, D and E are $345000, $275000, $250000, $125000 and $5000. What is the expected annual return for each investment and what is the annual rate of investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts