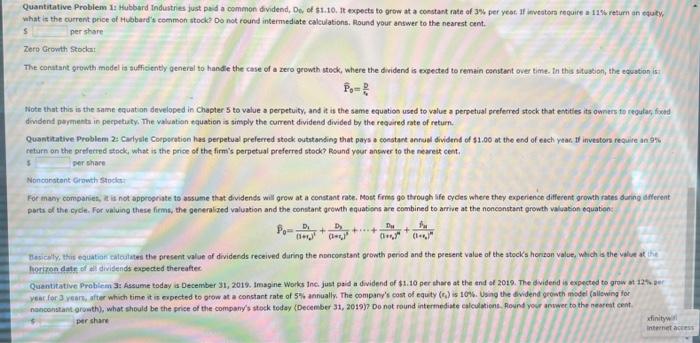

Question: Quantitative Problem 1: Hubberd Industries just ped a common dividend, De of 51.10 . It expects to grow at a constant nte of 3% per

Quantitative Problem 1: Hubberd Industries just ped a common dividend, De of 51.10 . It expects to grow at a constant nte of 3% per yeat. If investons regaire a 11 Wi refurn an equty, what is the current price of Hubbard's cemmon stockt Do not round intermediate calculations, Round your answer to the nearest cent. 5 per share Zerp Growth Stockat The conatant growth model is sufficienty general to handle the case of a zero growth stock, where the dividend is exected to renain constant over time. in this situsbion, the eouabion is: P0=1D Note that this is the same equation developed in Chapter 5 to value a perpetuity, and it is the same equation used to value a perpetual prefered stock that entities its owners to regular, ficad divdond parmentr in pecpetaty, the valuation equation is simply the current dividend divided by the reguired rate of return. Qusntitative Problem 2 Calyile Coeporation has perpetual preferred stock outstanding that pays a constare anfud dividend of 11.00 at the end of each yeac if investons require an 9 is return on the orrlerred stack, what is the price of the firm's perpetual preferred stock? Rodnd your answer to the neareit cent. per share Nonconstant Grawth stockiti parts of the cyole. For valuing these firms, the generalixed valuation and the constant growth equatigns are conbined to arrive at the nonconstant gromth valuatian equations Dessicilly, this equatian calcutates the preberit value of dividends received during the nonconstant prowth period and the peesent value of the atocks horizon value, waich a the value at the forifon date of all difilends expeded thereaftec Quentutative Probiem 3: Assume today a December 31, 2019. Imag ne Woiks ine. just paid a dividend of \$1.10 per thare at the end ot 2019 . The d vidend is expected to grow at 12\% aer Year for 3 yearh, after which time it is expected to gtow at a constant rate of 5% annually. The compang's cost of equity (r.) is 10 ond. Using the dvidend gromth model (allewing for nonoonstant groath), what should be che price of the company's stock todey \{December 31, 2019)? Do not round intermediate calculatient. Aound yosr anwer to the neareat cent. per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts