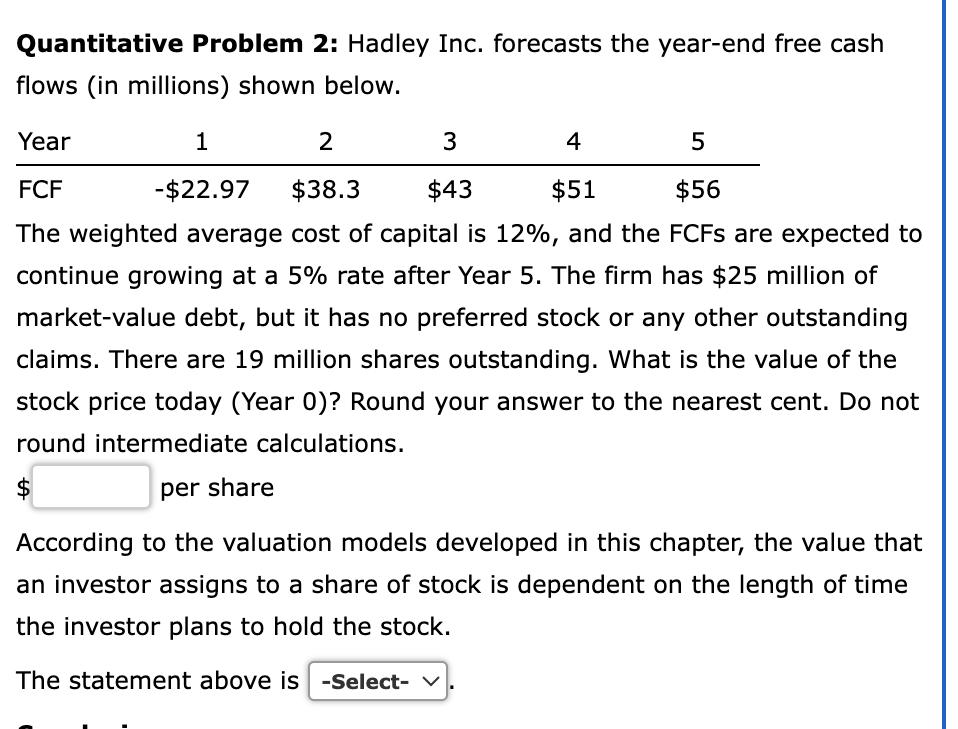

Question: Quantitative Problem 2 : Hadley Inc. forecasts the year - end free cash flows ( in millions ) shown below. The weighted average cost of

Quantitative Problem : Hadley Inc. forecasts the yearend free cash

flows in millions shown below.

The weighted average cost of capital is and the FCFs are expected to

continue growing at a rate after Year The firm has $ million of

marketvalue debt, but it has no preferred stock or any other outstanding

claims. There are million shares outstanding. What is the value of the

stock price today Year Round your answer to the nearest cent. Do not

round intermediate calculations.

$

per share

According to the valuation models developed in this chapter, the value that

an investor assigns to a share of stock is dependent on the length of time

the investor plans to hold the stock.

The statement above isHadley Inc. forecasts the yearend free cash flows in millions shown below.

Year

FCF $ $ $ $ $

The weighted average cost of capital is and the FCFs are expected to continue growing at a rate after Year The firm has $ million of marketvalue debt, but it has no preferred stock or any other outstanding claims. There are million shares outstanding. What is the value of the stock price today Year Round your answer to the nearest cent. Do not round intermediate calculations.

$

per share

According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock.

The statement above is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock