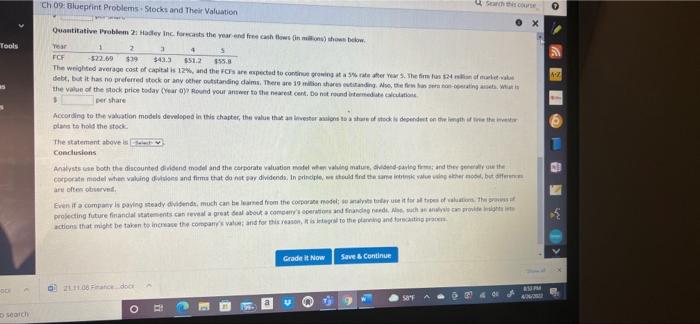

Question: Tools Ch 09: Blueprint Problems - Stocks and Their Valuation 0 X Quantitative Problem 2. Hade Inc. forecasts the year and free cash flows in

Tools Ch 09: Blueprint Problems - Stocks and Their Valuation 0 X Quantitative Problem 2. Hade Inc. forecasts the year and free cash flows in the Year FCF -222.69 $19 $433 551.2 55.0 The weighted average cost of capital is 12%, and the rose expected to contine growing it are there. The time debt, but it has no preferred stock or any other outstanding dame. There are 19 in the viding the foot the value of the stock price today (Year Round your answer to the nearestent. Do not und die per share According to the valuation models developed in this chapter, the value that an investorite toodet on the with relation and to hold the stock The statement above is a Conclusions Analysts both the discounted and model and the corporate valuation made her valuing matand there corporate model when valing and firms that do not ar dividendo. In principle would the same in tiskale but der are oftenere Even if a company is paying tedy dividende, much can be learned from the comprende te li todet for this protecting future financial statements can towel a great deal otcome and findende sproete actions that might be taken to increase the company's and for this reason, to the point for me Grade it Now Save & Continue - 11.00 Fodbor 5897 6 GB O i och Tools Ch 09: Blueprint Problems - Stocks and Their Valuation 0 X Quantitative Problem 2. Hade Inc. forecasts the year and free cash flows in the Year FCF -222.69 $19 $433 551.2 55.0 The weighted average cost of capital is 12%, and the rose expected to contine growing it are there. The time debt, but it has no preferred stock or any other outstanding dame. There are 19 in the viding the foot the value of the stock price today (Year Round your answer to the nearestent. Do not und die per share According to the valuation models developed in this chapter, the value that an investorite toodet on the with relation and to hold the stock The statement above is a Conclusions Analysts both the discounted and model and the corporate valuation made her valuing matand there corporate model when valing and firms that do not ar dividendo. In principle would the same in tiskale but der are oftenere Even if a company is paying tedy dividende, much can be learned from the comprende te li todet for this protecting future financial statements can towel a great deal otcome and findende sproete actions that might be taken to increase the company's and for this reason, to the point for me Grade it Now Save & Continue - 11.00 Fodbor 5897 6 GB O i och

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts