Question: Quantitative Problem: An analyst evaluating securities has obtained the following information. The real rate of interest is 2 . 7 % and is expected to

Quantitative Problem:

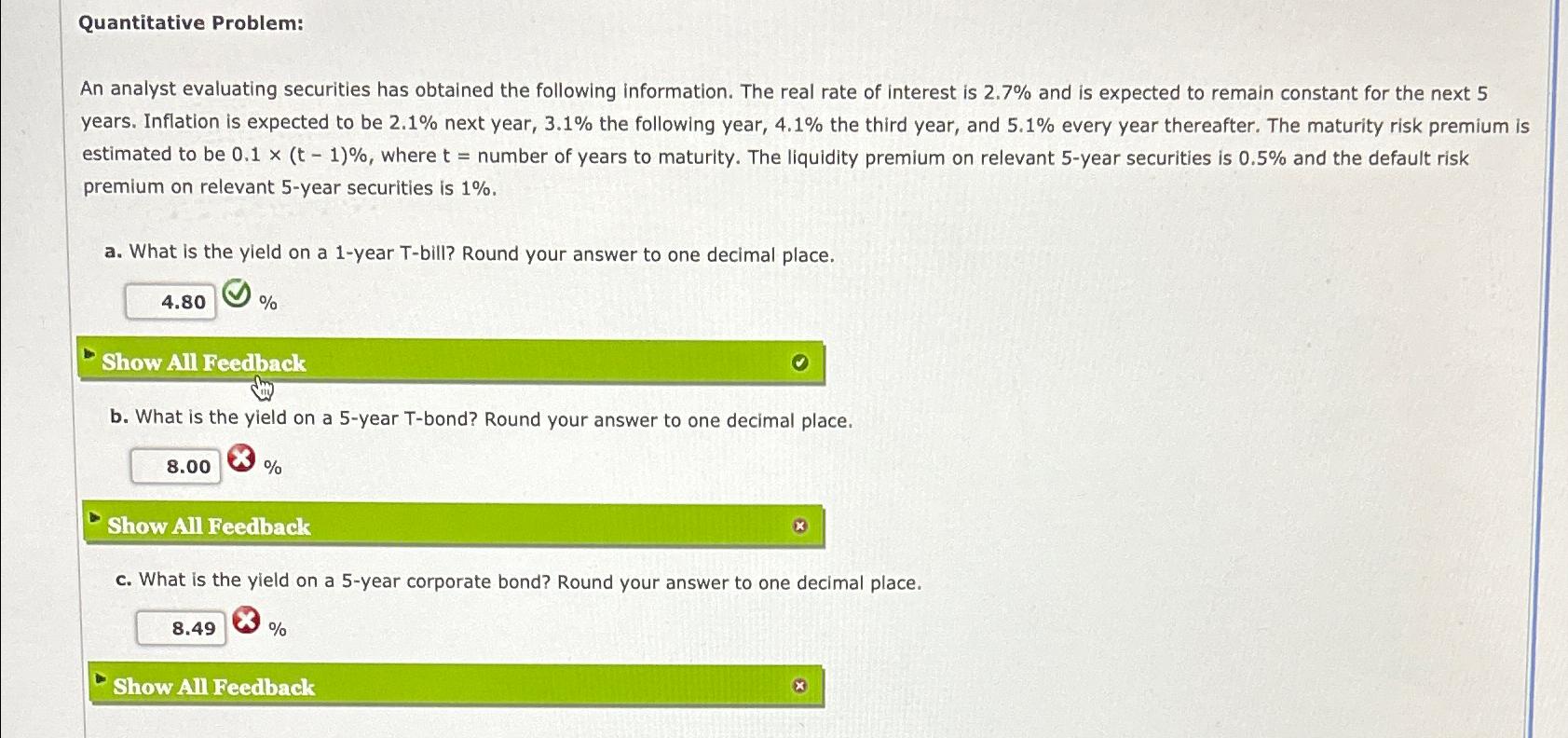

An analyst evaluating securities has obtained the following information. The real rate of interest is and is expected to remain constant for the next years. Inflation is expected to be next year, the following year, the third year, and every year thereafter. The maturity risk premium is estimated to be where number of years to maturity. The liquidity premium on relevant year securities is and the default risk premium on relevant year securities is

a What is the yield on a year Tbill? Round your answer to one decimal place.

Show All Feedback

b What is the yield on a year Tbond? Round your answer to one decimal place.

Show All Feedback

c What is the yield on a year corporate bond? Round your answer to one decimal place.

Show All Feedback

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock