Question: Quantitative Problem: Barton Industries expects next year's annual dividend, D 1 , to be $ 1 . 7 0 and it expects dividends to grow

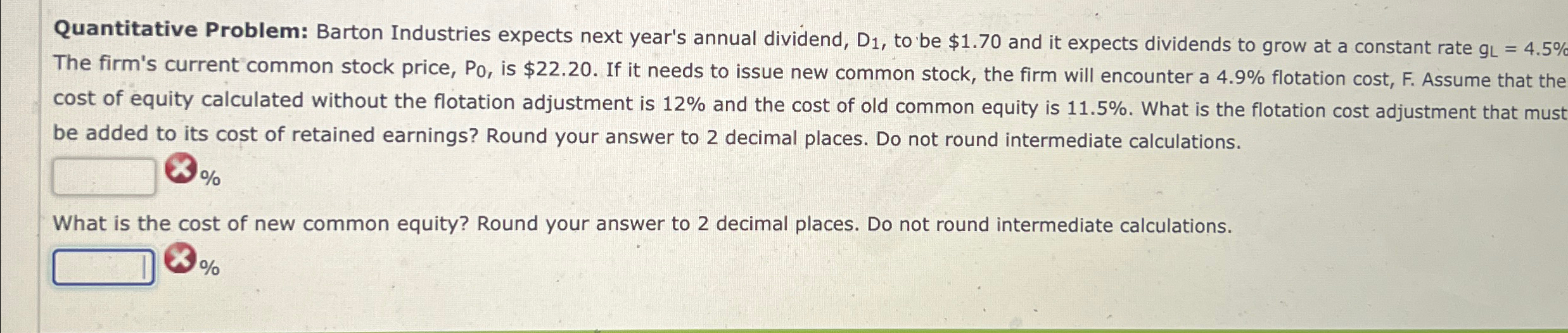

Quantitative Problem: Barton Industries expects next year's annual dividend, to be $ and it expects dividends to grow at a constant rate The firm's current common stock price, is $ If it needs to issue new common stock, the firm will encounter a flotation cost, F Assume that the cost of equity calculated without the flotation adjustment is and the cost of old common equity is What is the flotation cost adjustment that must be added to its cost of retained earnings? Round your answer to decimal places. Do not round intermediate calculations.

What is the cost of new common equity? Round your answer to decimal places. Do not round intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock