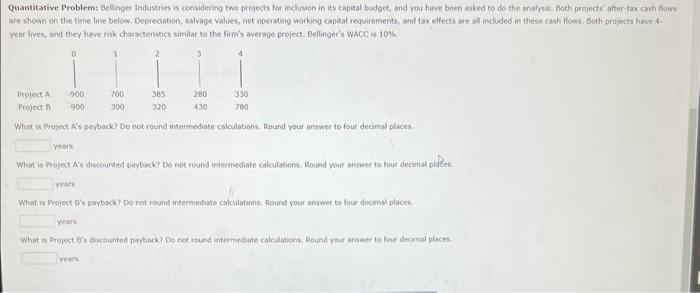

Question: Quantitative Problem: Belinger Industries is considening two projects for inclusion in its capital budget, and you heve been asked to do the analysis. Both projects

Quantitative Problem: Belinger Industries is considening two projects for inclusion in its capital budget, and you heve been asked to do the analysis. Both projects after tar cash flows are stown on the time line below. Deprecation, salvage values, net operating worlong capital requirements, and tax elfects are atl included in these cash flows. Both prajocts have in vear Iives, and they have risk characterstics similar to the firm's average project. Bellinger's WACC w 10\%s. What is froject A's partack? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project A s discoumed paiyback? Do not round intermediate calculatiens. Round your answer to four deoinal places. years What is Project bis payback? Do not round intermediate calculations. Round your anwer to four decamal placek: years What is Project B's dincounted payback? Do not round intermediate calculaticens. Round your answer to four decimal places. Years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts