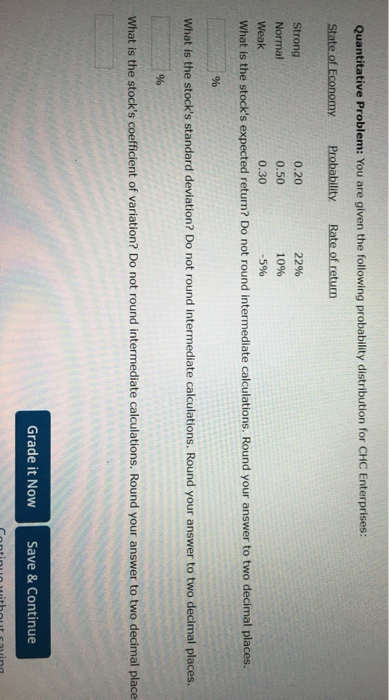

Question: Quantitative Problem: You are given the following probability distribution for CHC Enterprises: State of Economy Probability Rate of return Strong 0.20 22% Normal 0.50 10%

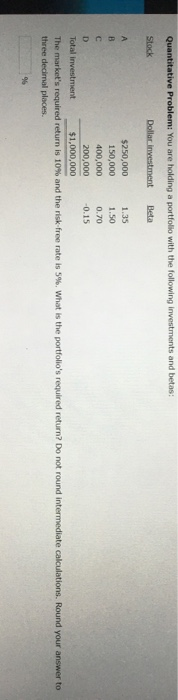

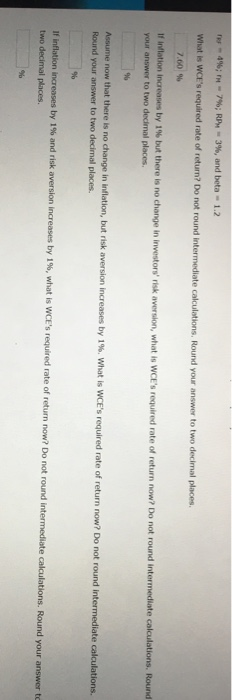

Quantitative Problem: You are given the following probability distribution for CHC Enterprises: State of Economy Probability Rate of return Strong 0.20 22% Normal 0.50 10% Weak 0.30 -5% What is the stock's expected return? Do not round intermediate calculations. Round your answer to two decimal places. % What is the stock's standard deviation? Do not round intermediate calculations. Round your answer to two decimal places. % What is the stock's coefficient of variation? Do not round intermediate calculations, Round your answer to two decimal place Grade it Now Save & Continue Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta $250,000 1.35 B 150,000 1.50 400,000 0.70 D 200,000 -0.15 Total investment $1,000,000 The market's required return is 10% and the risk free rate is 5%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places. 96 e-4%; H - 7%; RP - 3%, and beta - 1.2 What is WCE's required rate of return? Do not round intermediate calculations, Round your answer to two decimal places 7.60 % of station Increases by 1% but there is no change in investors' risk aversion, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. 96 Assume now that there is no change in Inflation, but risk aversion increases by 1%. What is we's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. 9 f inflation increases by 1% and risk aversion increases by 1%, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts