Question: Quantitative tax problem: (40 points) -- Create a professional looking table to present your results. 1. Assume that the supply of a luxury product

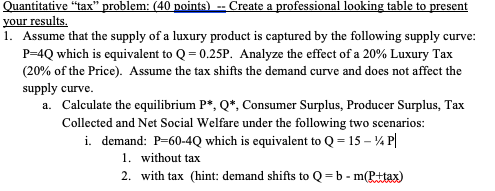

Quantitative "tax" problem: (40 points) -- Create a professional looking table to present your results. 1. Assume that the supply of a luxury product is captured by the following supply curve: P=4Q which is equivalent to Q=0.25P. Analyze the effect of a 20% Luxury Tax (20% of the Price). Assume the tax shifts the demand curve and does not affect the supply curve. a. Calculate the equilibrium P*, Q*, Consumer Surplus, Producer Surplus, Tax Collected and Net Social Welfare under the following two scenarios: i. demand: P=60-4Q which is equivalent to Q = 15 - P| 1. without tax 2. with tax (hint: demand shifts to Q-b-m(P+tax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts