Question: Quantitive Problem 3 2uantitative Problem: Bellinger Lndustres os considenng two projects for incluven in its capital budget, arid you hove been asked to do the

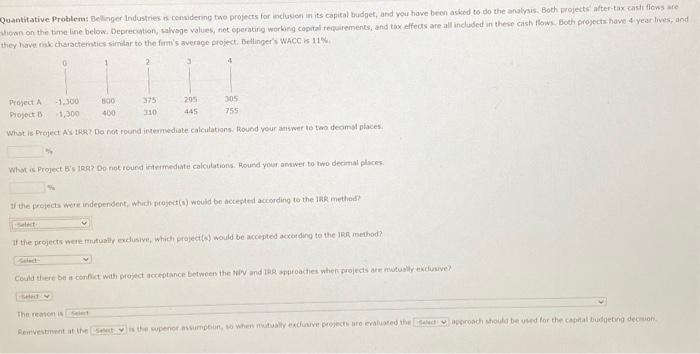

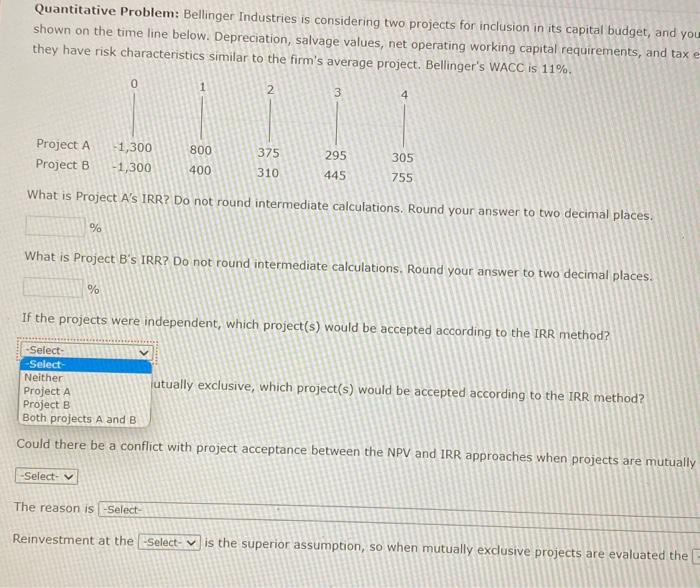

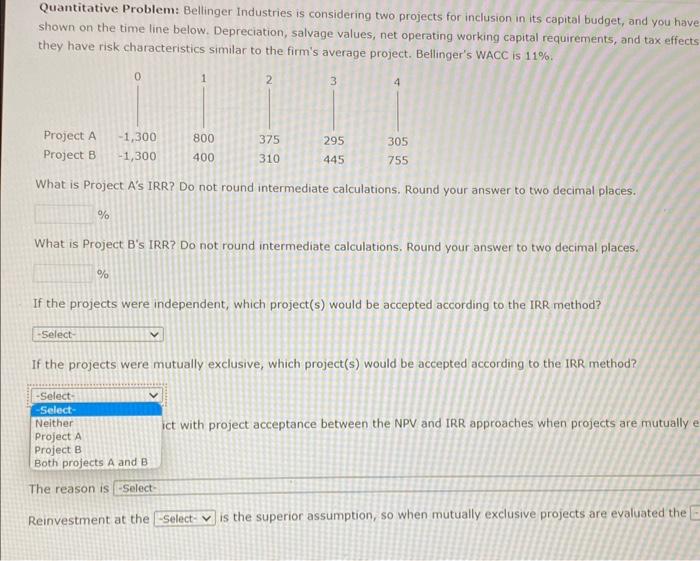

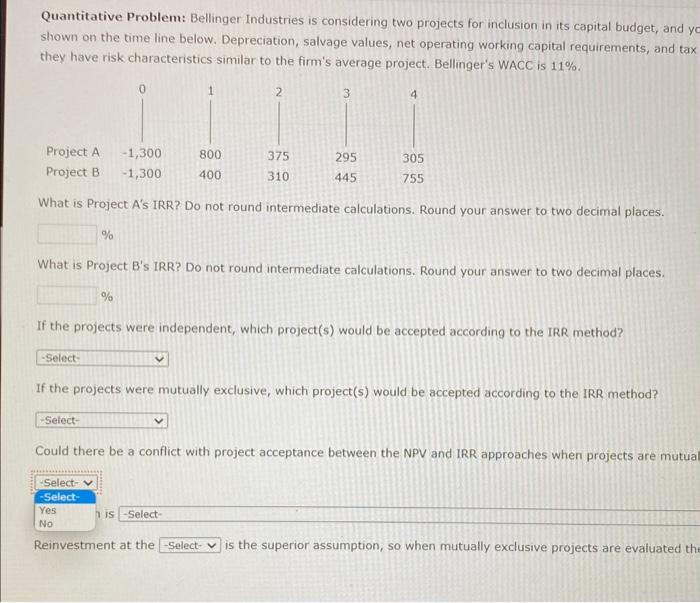

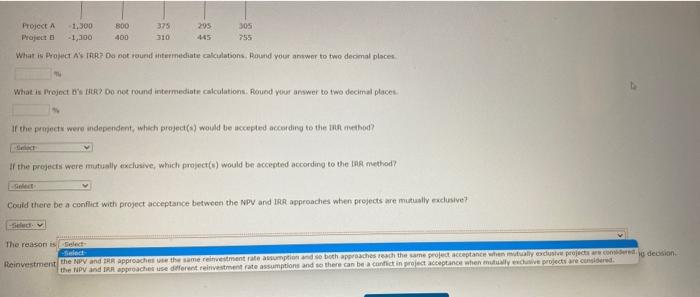

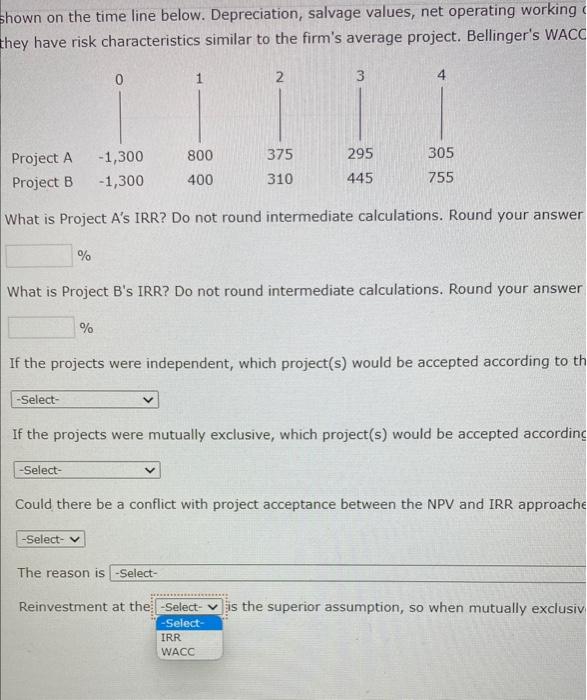

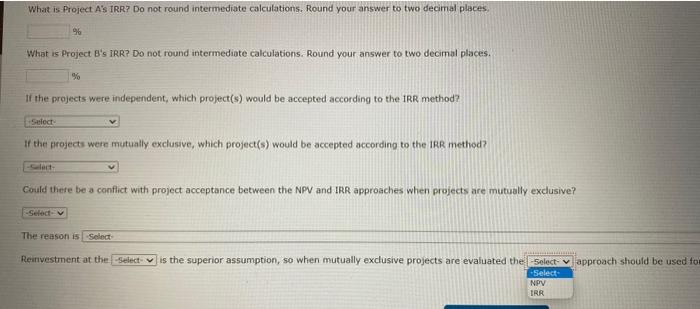

2uantitative Problem: Bellinger Lndustres os considenng two projects for incluven in its capital budget, arid you hove been asked to do the analysis. Both projects' atter-tax eashif flons are Whown on the tame line below. Deprecution, salvoge values, net operatirig workeng copital requirements, and tax effects are all induded in these cash liowi. both propects have 4 year lives, and. they have riok characterotics similar to the firn's average propect. Gelinger's WaCC is 11%. Whot is Project AS IRA? Do not round imemediate calculations. Round your answer to tan deams phaces. Whot is Project B's 10g? Do not round intermediate calculations. Aevind your amiwer to bwo decimal places. IV the projects wore independent, which jiroject(s) would be accepted acoording to the ing method? If the projects nete mutualli, ecdusive. which project(w) would be accepted accotding to the 110 method? The remton is Aeineitment at the awrosch should be uked for the caphal buesoting deceion. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax they have risk characteristics similar to the firm's average project. Bellinger's WACC is 11%. What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? Itually exclusive, which project(s) would be accepted according to the IRR method? Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually The reason is -Select- Reinvestment at the is the superior assumption, so when mutually exclusive projects are evaluated the Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects they have risk characteristics similar to the firm's average project. Bellinger's WACC is 11%. What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? ict with project acceptance between the NPV and IRR approaches when projects are mutually The reason is -5elect- Reinvestment at the is the superior assumption, so when mutually exclusive projects are evaluated the Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and y shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax they have risk characteristics similar to the firm's average project. Bellinger's WACC is 11\%. What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutua is - Select- Reinvestment at the is the superior assumption, so when mutually exclusive projects are evaluated th What is Propect As FRBR? Do not raurid antermediate calcidations. Round vour antwer to two deomal places. What is Project b's ftr? Do net round intermediate calculations. Pouind wour answer to tao decimal places. If the propects were independent, which project(s) would be ascepled accotding to the lugt myethod? If the projects wore muabally exclusive, which project(s) would be acceoted according to the tag msethod? Could there be a conflirt with project acceptance between the NPY and IRR approaches when projects are miatially eadu shown on the time line below. Depreciation, salvage values, net operating working chey have risk characteristics similar to the firm's average project. Bellinger's WACC What is Project A's IRR? Do not round intermediate calculations. Round your answer % What is Project B's IRR? Do not round intermediate calculations. Round your answer % If the projects were independent, which project(s) would be accepted according to If the projects were mutually exclusive, which project(s) would be accepted accordin Could there be a conflict with project acceptance between the NPV and IRR approach The reason is -Select- What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? If the froject were mutually exclusve, which project(s) would be accepted according to the IRR method? Corild there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? The reason is select: Reinvestment at the is the superior assumption, so when mutually exclusive projects are evaluated the approach should be used f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts