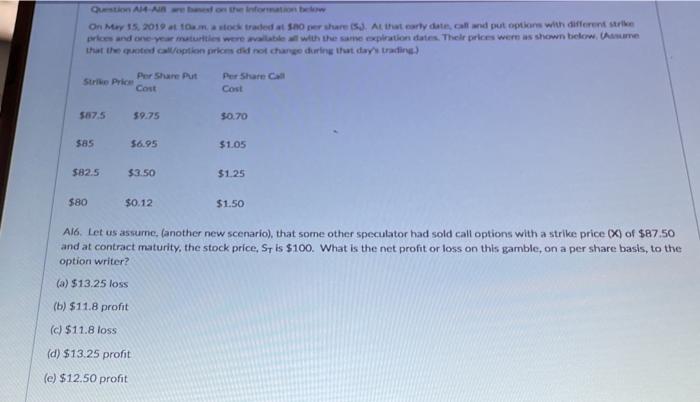

Question: Quest A to the information below On May 15, 2019 mod traded as per the 5). Al that early date, call put options with different

Quest A to the information below On May 15, 2019 mod traded as per the 5). Al that early date, call put options with different sur prices and one armatures were able with the same expletion dates. The prices were as shown below. Asume that the quoted caption prices not change during that day's trading) Strike Price Per Share Put Cost Per Shams Cost 5875 59.75 30.70 $85 56.95 $1.05 $82.5 $3.50 $1.25 $80 $0.12 $1.50 Alb. Let us assure. (another new scenario), that some other speculator had sold call options with a strike price (X) of $87.50 and at contract maturity, the stock price. Sy is $100. What is the net profit or loss on this gamble, on a per share basis, to the option writer? (a) $13.25 loss (b) $11.8 profit (c) $11.8 loss (d) $13.25 profit (e) $12.50 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts