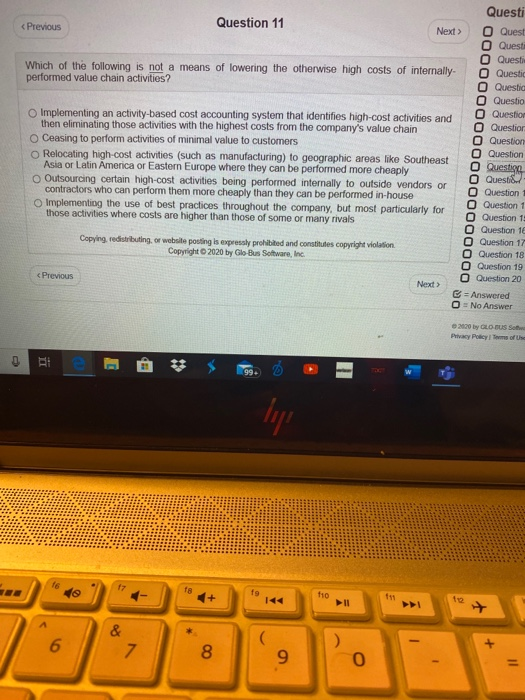

Question: Questi Question 11 O Quest O Questi O Questi Which of the following is not a means of lowering the otherwise high costs of internally

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock