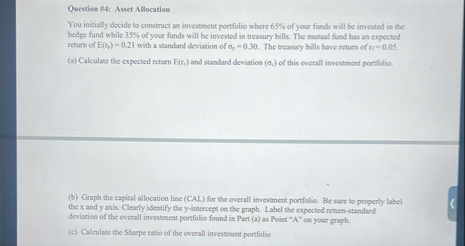

Question: Questioe I 4 : Asset Allocation You initially decide to construct an imvestment portfolio where 6 5 % of your funds will be invested in

Questioe I: Asset Allocation

You initially decide to construct an imvestment portfolio where of your funds will be invested in the bedge fund while of your funds will be invested in treasury bills. The mutual fund has an expected return of with a standard deviation of The treasary bills have return of

a Calculane the expected return and standard deviation of this overall investment portiolio.

b Graph the capital allocation line CAL for the overall investment portfolia. Be sare to properly label the x and y axis. Clearly identify the y intercept oe the graph. Label the expected returnstandard deviation of the overall investment portfotio found in Patt es Point on your grapth.

c Calculate the Sharpe ratio of the overall investment portfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock