Question: Question 02 Florence Nightingale's have to decide upon two different machines to make a new range of lamps so that they can continue to extend

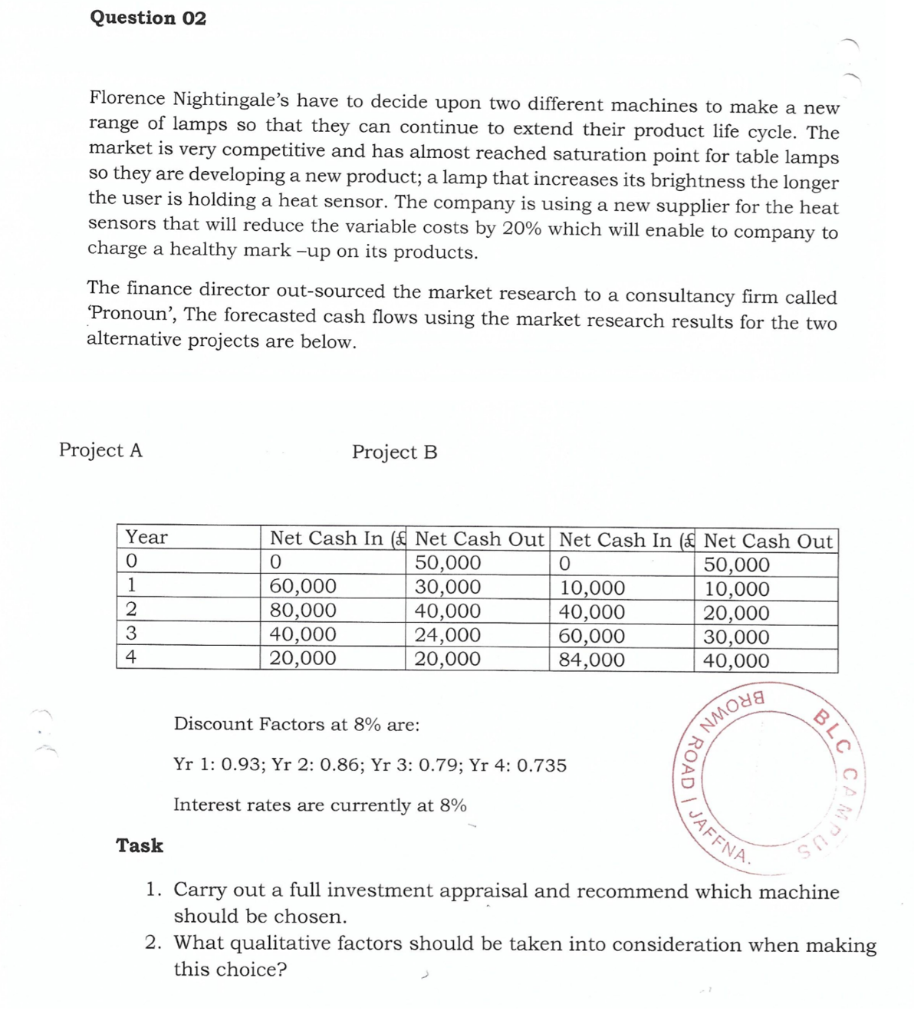

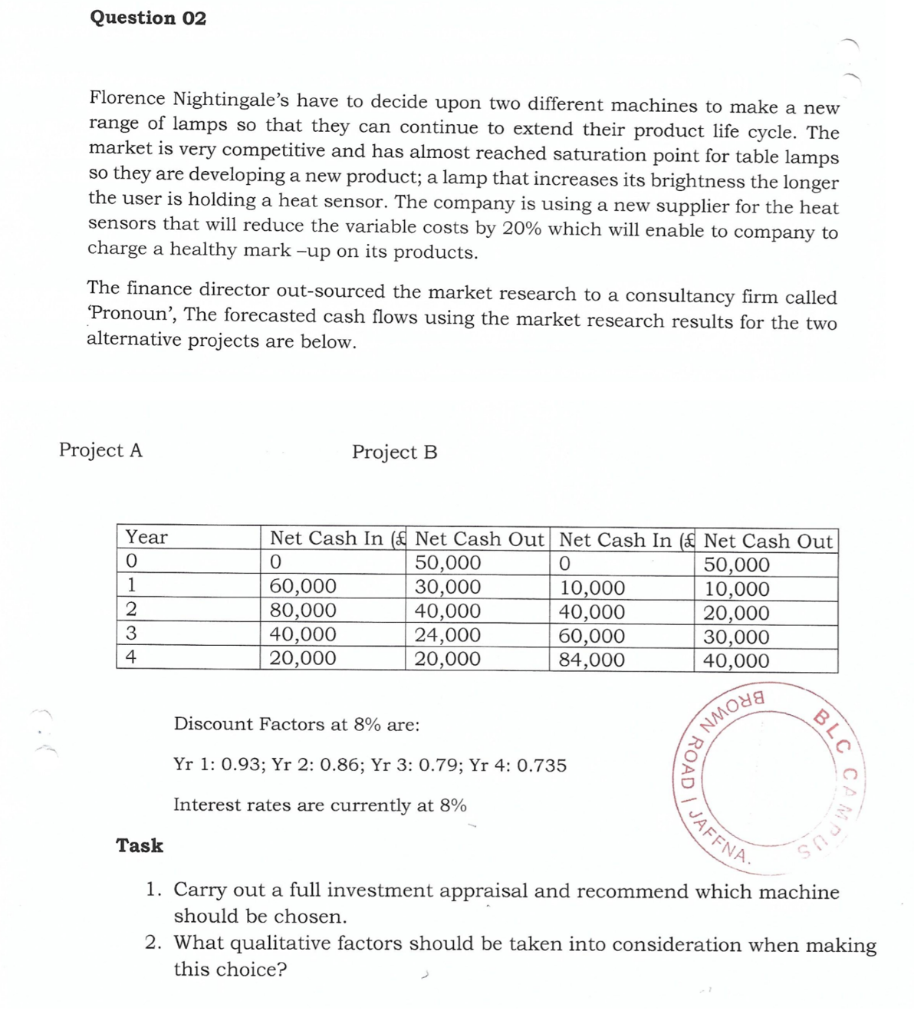

Question 02 Florence Nightingale's have to decide upon two different machines to make a new range of lamps so that they can continue to extend their product life cycle. The market is very competitive and has almost reached saturation point for table lamps so they are developing a new product; a lamp that increases its brightness the longer the user is holding a heat sensor. The company is using a new supplier for the heat sensors that will reduce the variable costs by 20% which will enable to company to charge a healthy mark-up on its products. The finance director out-sourced the market research to a consultancy firm called Pronoun', The forecasted cash flows using the market research results for the two alternative projects are below. Project A Project B Year O Net Cash In Net Cash Out Net Cash In (& Net Cash Out 50,000 50,000 60,000 30,000 10,000 10,000 80,000 40,000 40,000 20,000 40,000 24,000 60,000 30,000 20,000 20,000 84,000 40,000 Discount Factors at 8% are: ANMoya BLC Yr 1: 0.93; Yr 2: 0.86; Yr 3: 0.79; Yr 4: 0.735 ADS Interest rates are currently at 8% AFFNA Task 1. Carry out a full investment appraisal and recommend which machine should be chosen. 2. What qualitative factors should be taken into consideration when making this choice? Question 02 Florence Nightingale's have to decide upon two different machines to make a new range of lamps so that they can continue to extend their product life cycle. The market is very competitive and has almost reached saturation point for table lamps so they are developing a new product; a lamp that increases its brightness the longer the user is holding a heat sensor. The company is using a new supplier for the heat sensors that will reduce the variable costs by 20% which will enable to company to charge a healthy mark-up on its products. The finance director out-sourced the market research to a consultancy firm called Pronoun', The forecasted cash flows using the market research results for the two alternative projects are below. Project A Project B Year O Net Cash In Net Cash Out Net Cash In (& Net Cash Out 50,000 50,000 60,000 30,000 10,000 10,000 80,000 40,000 40,000 20,000 40,000 24,000 60,000 30,000 20,000 20,000 84,000 40,000 Discount Factors at 8% are: ANMoya BLC Yr 1: 0.93; Yr 2: 0.86; Yr 3: 0.79; Yr 4: 0.735 ADS Interest rates are currently at 8% AFFNA Task 1. Carry out a full investment appraisal and recommend which machine should be chosen. 2. What qualitative factors should be taken into consideration when making this choice