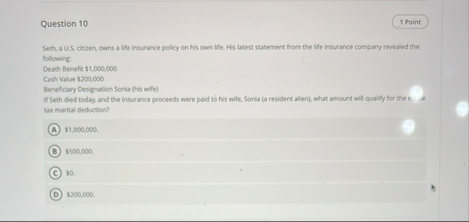

Question: Question 1 0 Seth a US . ctizen cown a life insurance policy on his own life. Hes latest statement from the life insurance company

Question

Seth a US ctizen cown a life insurance policy on his own life. Hes latest statement from the life insurance company revtaled the following:

Death Benefis $

Cash value $

Beneficary Desiguation Sonia pis wife

Seth ceed todag, and the insurance prockeds were paid to his wife, Sonis fa resident alienl, what amount will qualify for thee. at tax marital deduction?

$

:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock