Question: QUESTION 1 0.5 points (Extra Credit) Save Answer With respect to transaction and translation gains and losses: a. transaction gains and losses are taxable but

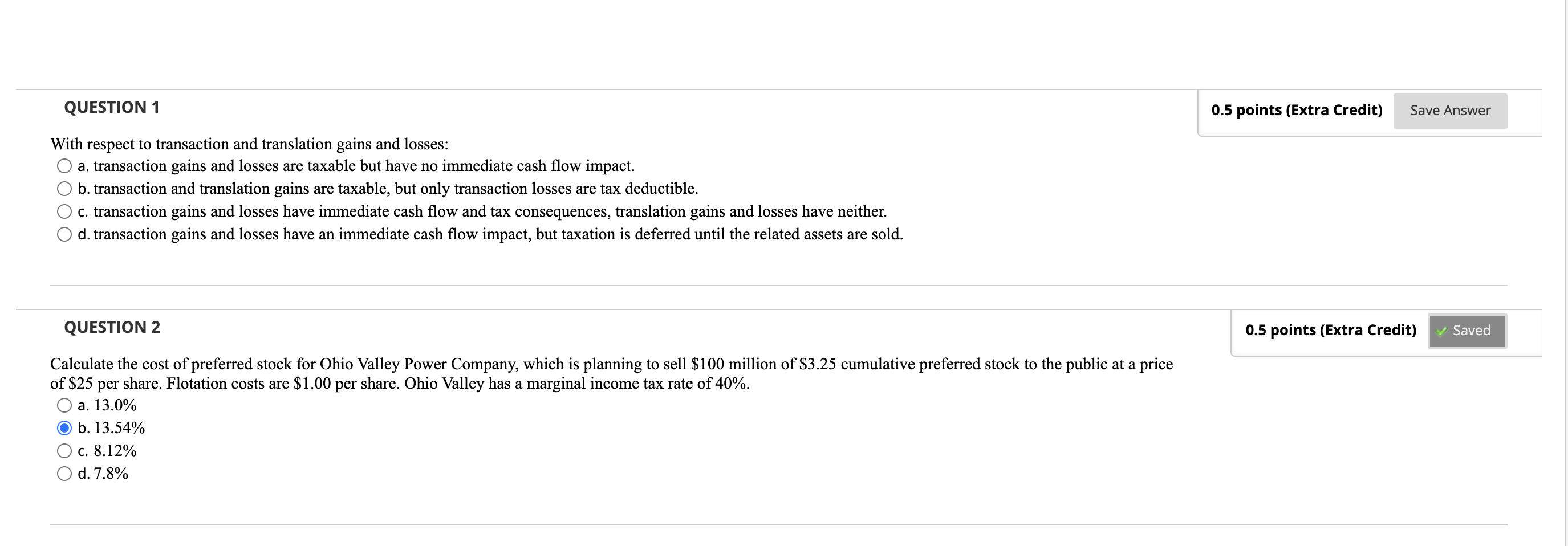

QUESTION 1 0.5 points (Extra Credit) Save Answer With respect to transaction and translation gains and losses: a. transaction gains and losses are taxable but have no immediate cash flow impact. b. transaction and translation gains are taxable, but only transaction losses are tax deductible. c. transaction gains and losses have immediate cash flow and tax consequences, translation gains and losses have neither. d. transaction gains and losses have an immediate cash flow impact, but taxation is deferred until the related assets are sold. QUESTION 2 0.5 points (Extra Credit) Saved Calculate the cost of preferred stock for Ohio Valley Power Company, which is planning to sell $ 100 million of $3.25 cumulative preferred stock to the public at a price of $25 per share. Flotation costs are $1.00 per share. Ohio Valley has a marginal income tax rate of 40%. a. 13.0% b. 13.54% C. 8.12% d. 7.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts