Question: QUESTION 1 0.5 points Save Answer Nelson's stock has a beta of 1,2 and a required rate of return of 11.50%. Canton's stock has a

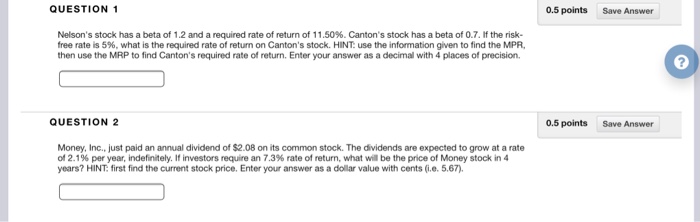

QUESTION 1 0.5 points Save Answer Nelson's stock has a beta of 1,2 and a required rate of return of 11.50%. Canton's stock has a beta of 07. If the risk- free rate is 5%, what is the required rate of return on Canton's stock. HINT: use the information given to find the MPR, then use the MRP to find Canton's required rate of return. Enter your answer as a decimal with 4 places of precision 2 QUESTION 2 0.5 points Save Answer Money, Inc., just paid an annual dividend of $2.08 on its common stock. The dividends are expected to grow at a rate of 2.1% per year, indefinitely. If investors require an 7.3% rate of return, what will be the price of Money stock in 4 years? HINT: first find the current stock price. Enter your answer as a dolar value with cents (i.e. 5.67)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts