Question: Question 1 1 0 pts Note: Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act Tax - FICA tax.

Question

pts

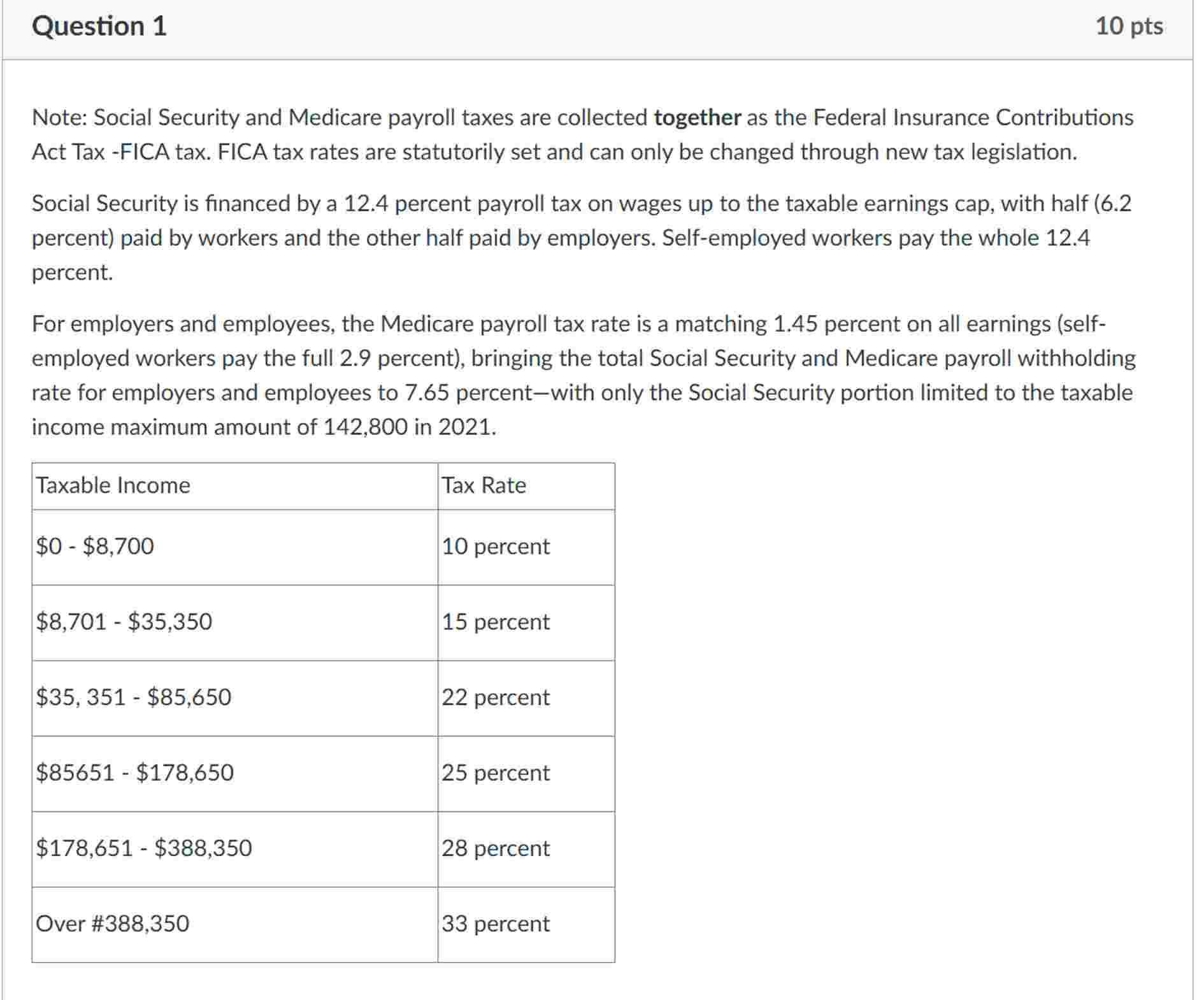

Note: Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act Tax FICA tax. FICA tax rates are statutorily set and can only be changed through new tax legislation.

Social Security is financed by a percent payroll tax on wages up to the taxable earnings cap, with half percent paid by workers and the other half paid by employers. Selfemployed workers pay the whole percent.

For employers and employees, the Medicare payroll tax rate is a matching percent on all earnings selfemployed workers pay the full percent bringing the total Social Security and Medicare payroll withholding rate for employers and employees to percentwith only the Social Security portion limited to the taxable income maximum amount of in

begintabularll

hline Taxable Income & Tax Rate

hline$ $ & percent

hline$ $ & percent

hline$ $ & percent

hline$ $ & percent

hline$ $ & percent

hline Over # & percent

hline

endtabular An employee made $ in and based on the information in the table above, please answer the following questions. You should not spend more than minutes on this question.

What was the total amount this employee paid in social insurance taxes, comprising both social security and Medicare taxes?

What was the federal income tax bill liability for this employee

What was the average income tax rate for this employee

What was the total payroll tax amount for this employee, including federal income tax, social security, and Medicare taxes, assuming no state and local income taxes? An employee made $ in and based on the information in the table above, please answer the following questions. You should not spend more than minutes on this question.

What was the total amount this employee paid in social insurance taxes, comprising both social security and Medicare taxes?

What was the federal income tax bill liability for this employee

What was the average income tax rate for this employee

What was the total payroll tax amount for this employee, including federal income tax, social security, and Medicare taxes, assuming no state and local income taxes?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock