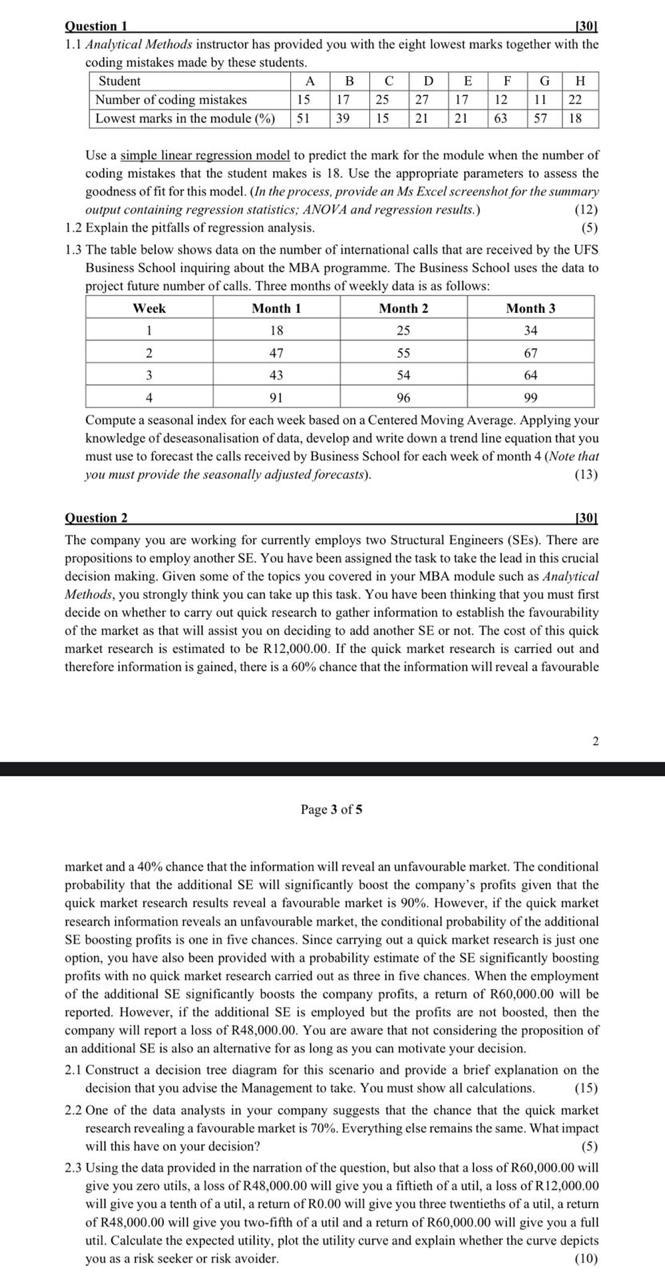

Question: Question 1 1 . 1 Analytical Methods instructor has provided you with the eight lowest marks together with the coding mistakes made by these students.

Question

Analytical Methods instructor has provided you with the eight lowest marks together with the coding mistakes made by these students.

Use a simple linear regression model to predict the mark for the module when the number of coding mistakes that the student makes is Use the appropriate parameters to assess the goodness of fit for this model. In the process, provide an Ms Excel screenshot for the summary output containing regression statistics; ANOVA and regression results.

Explain the pitfalls of regression analysis.

The table below shows data on the number of international calls that are received by the UFS Business School inquiring about the MBA programme. The Business School uses the data to project future number of calls. Three months of weekly data is as follows:

Compute a seasonal index for each week based on a Centered Moving Average. Applying your knowledge of deseasonalisation of data, develop and write down a trend line equation that you must use to forecast the calls received by Business School for each week of month Note that you must provide the seasonally adjusted forecasts

Question

The company you are working for currently employs two Structural Engineers SEs There are propositions to employ another SE You have been assigned the task to take the lead in this crucial decision making. Given some of the topics you covered in your MBA module such as Analytical Methods, you strongly think you can take up this task. You have been thinking that you must first decide on whether to carry out quick research to gather information to establish the favourability of the market as that will assist you on deciding to add another SE or not. The cost of this quick market research is estimated to be R If the quick market research is carried out and therefore information is gained, there is a chance that the information will reveal a favourable

Page of

market and a chance that the information will reveal an unfavourable market. The conditional probability that the additional SE will significantly boost the company's profits given that the quick market research results reveal a favourable market is However, if the quick market research information reveals an unfavourable market, the conditional probability of the additional SE boosting profits is one in five chances. Since carrying out a quick market research is just one option, you have also been provided with a probability estimate of the SE significantly boosting profits with no quick market research carried out as three in five chances. When the employment of the additional SE significantly boosts the company profits, a return of mathrmR will be reported. However, if the additional SE is employed but the profits are not boosted, then the company will report a loss of R You are aware that not considering the proposition of an additional SE is also an alternative for as long as you can motivate your decision.

Construct a decision tree diagram for this scenario and provide a brief explanation on the decision that you advise the Management to take. You must show all calculations.

One of the data analysts in your company suggests that the chance that the quick market research revealing a favourable market is Everything else remains the same. What impact will this have on your decision?

Using the data provided in the narration of the question, but also that a loss of R will give you zero utils, a loss of R will give you a fiftieth of a util, a loss of R will give you a tenth of a util, a return of R will give you three twentieths of a util, a return of R will give you twofifth of a util and a return of R will give you a full util. Calculate the expected utility, plot the utility curve and explain whether the curve depicts you as a risk seeker or risk avoider.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock