Question: Question 1 : ( 1 5 points ) It is now May 8 , 2 0 2 5 , ARTEMIS Solar Corporation in Oakland California

Question : points

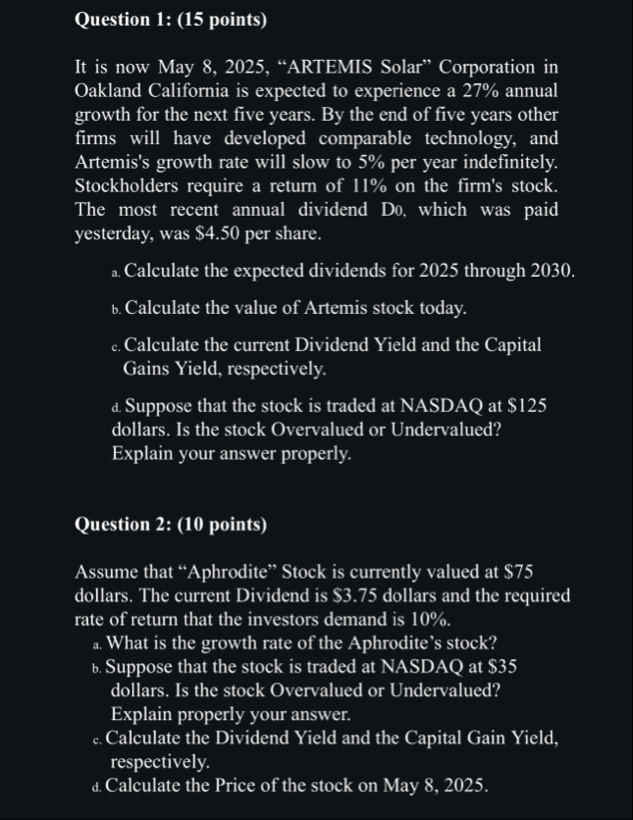

It is now May "ARTEMIS Solar" Corporation in Oakland California is expected to experience a annual growth for the next five years. By the end of five years other firms will have developed comparable technology, and Artemis's growth rate will slow to per year indefinitely. Stockholders require a return of on the firm's stock. The most recent annual dividend Do which was paid yesterday, was $ per share.

a Calculate the expected dividends for through

b Calculate the value of Artemis stock today.

c Calculate the current Dividend Yield and the Capital Gains Yield, respectively.

d Suppose that the stock is traded at NASDAQ at $ dollars. Is the stock Overvalued or Undervalued? Explain your answer properly.

Question : points

Assume that "Aphrodite" Stock is currently valued at $ dollars. The current Dividend is $ dollars and the required rate of return that the investors demand is

a What is the growth rate of the Aphrodite's stock?

b Suppose that the stock is traded at NASDAQ at $ dollars. Is the stock Overvalued or Undervalued? Explain properly your answer.

c Calculate the Dividend Yield and the Capital Gain Yield, respectively.

d Calculate the Price of the stock on May

Question : marks

Project "DELTA" has a cost of $ and is expected to produce benefits eg cash flows of $ per year for five years. Project "OMICRON" costs $ and is expected to produce cash flows of $ per year for five years.

Profitability Index Criterion, Payback Criterion and Discounted Payback Criterion, assuming a discount rate of

b Which project would be selected, if they are Mutually Exclusive, using each ranking method?

c Discuss in detail the advantagesdisadvantages associated with the Payback criterion.

d Which of all the abovementioned criteria is the best one for the appropriate selection of Independent and Mutually Exclusive projects?

Question : points

Consider a LOAN SIZE of dollars for six years and an interest rate of

a Calculate the Loan payment.

b Construct a proper Amortization Schedule and show all calculations.

c What kind of Annuity do you prefer when you are a borrower?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock