Question: Question 1 (1 point) Asset allocation is based on the expeciod returns and relative risk of each asset elass and bow it will coetribute to

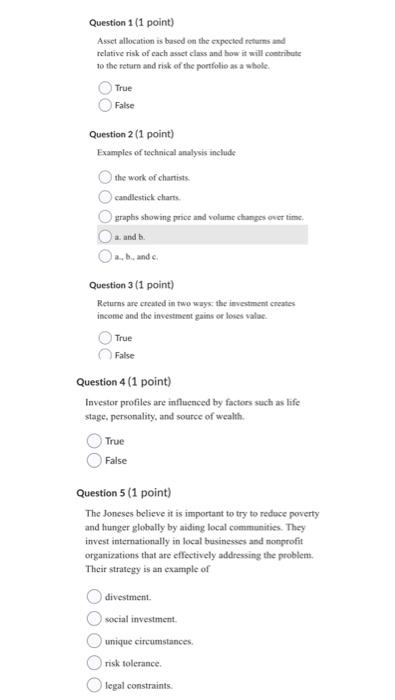

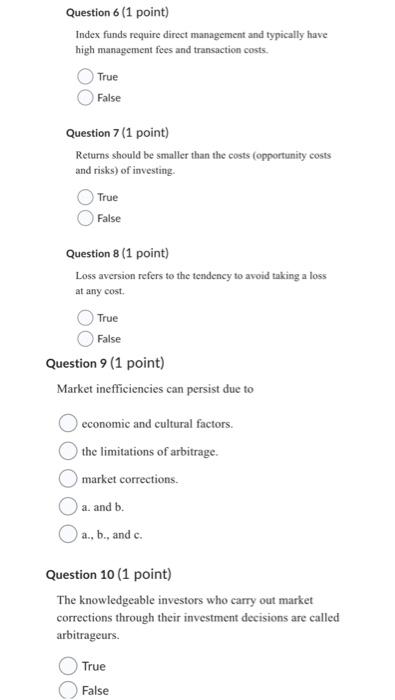

Question 1 (1 point) Asset allocation is based on the expeciod returns and relative risk of each asset elass and bow it will coetribute to the return and risk of the pontfolio as a whole. True False Question 2 ( 1 point) Examples of technical analysis include the work of chartists candlestick charts. graphs showing proce and volume changes over time. a. and b. a.. b.. and c. Question 3 (1 point) Returns are created in two ways, the invectment creates income and the investrect gains or loses valoe. True False Question 4 ( 1 point) lavestor profiles are influcnced by factors such as life stage, personality, and source of wealth. True False Question 5 ( 1 point) The Joneses believe it is important to try to reduce poverty and hunger globally by aiding local comununitics. They invest internationally in local businesses and nonprofit organizations that are effectively addressing the problem. Their strategy is an example of divestmen. social investment. unique circumstances. risk tolerance. legal constraints. Question 6 (1 point) Index funds require direct management and typically have high management fees and transaction costs. True False Question 7 (1 point) Returns should be smaller than the costs (opportunity costs and risks) of investing. True False Question 8 (1 point) Loss aversion refers to the tendency to avoid taking a loss at any cost. True False Question 9 ( 1 point) Market inefficiencies can persist due to economic and cultural factors. the limitations of arbitrage. market corrections. a. and b. a., b., and c. Question 10 (1 point) The knowledgeable investors who carry out market corrections through their investment decisions are called arbitrageurs. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts