Question: Question 1 (1 point) Consider a 7-year bond with face value F=$1000, annual coupon 40$. The interest rate is 4%. In a market with no

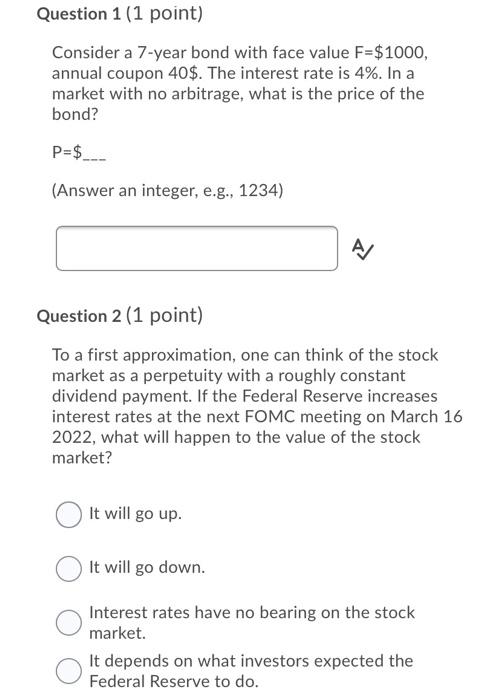

Question 1 (1 point) Consider a 7-year bond with face value F=$1000, annual coupon 40$. The interest rate is 4%. In a market with no arbitrage, what is the price of the bond? P=$. (Answer an integer, e.g., 1234) A/ Question 2 (1 point) To a first approximation, one can think of the stock market as a perpetuity with a roughly constant dividend payment. If the Federal Reserve increases interest rates at the next FOMC meeting on March 16 2022, what will happen to the value of the stock market? It will go up. It will go down Interest rates have no bearing on the stock market. It depends on what investors expected the Federal Reserve to do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts