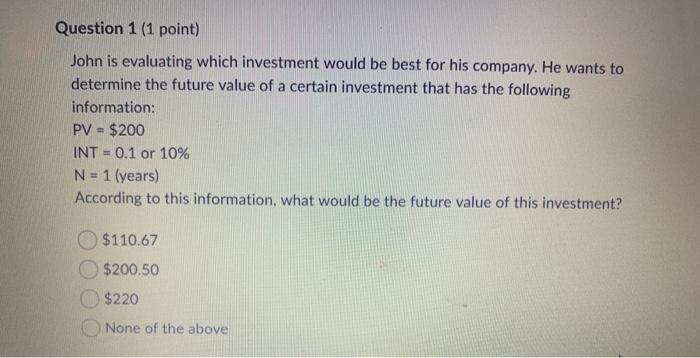

Question: Question 1 (1 point) John is evaluating which investment would be best for his company. He wants to determine the future value of a certain

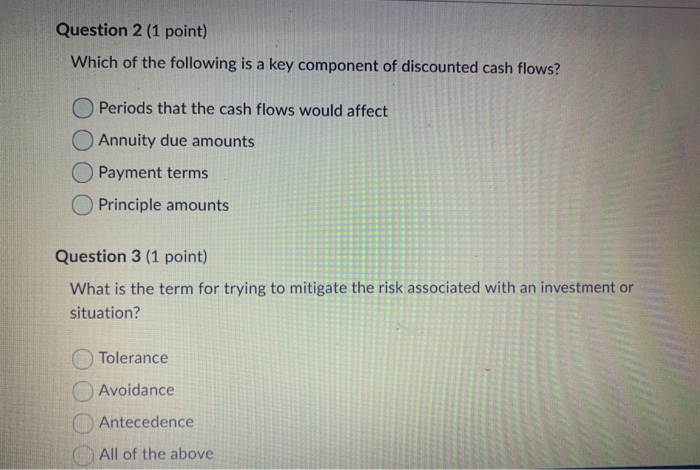

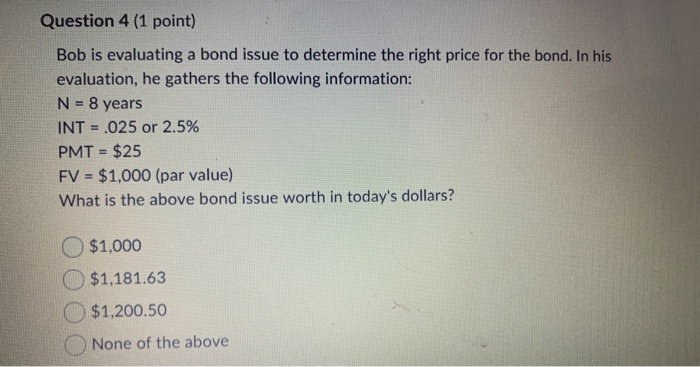

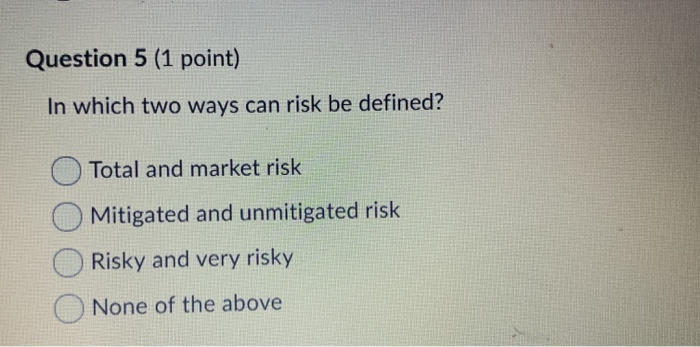

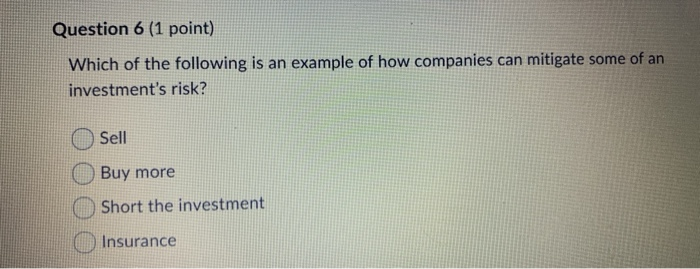

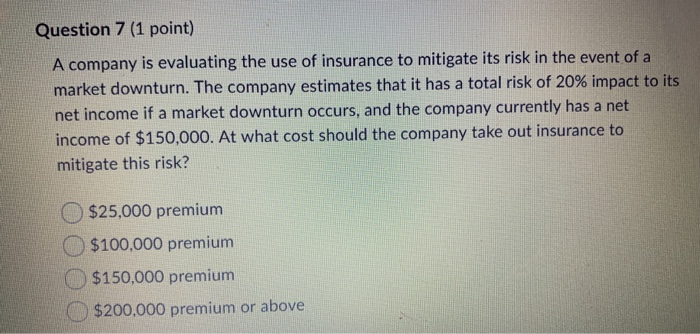

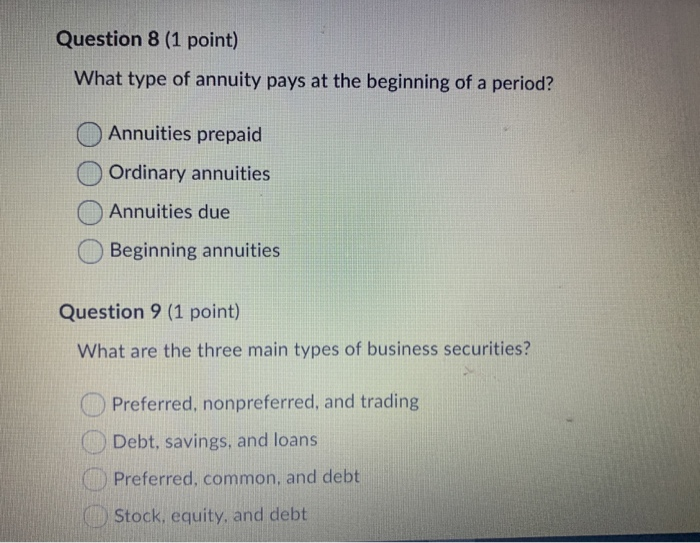

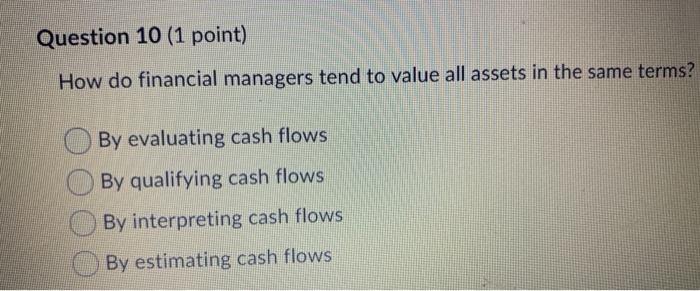

Question 1 (1 point) John is evaluating which investment would be best for his company. He wants to determine the future value of a certain investment that has the following information: PV = $200 INT = 0.1 or 10% N = 1 (years) According to this information, what would be the future value of this investment? $110.67 $200.50 $220 None of the above Question 2 (1 point) Which of the following is a key component of discounted cash flows? Periods that the cash flows would affect Annuity due amounts Payment terms Principle amounts Question 3 (1 point) What is the term for trying to mitigate the risk associated with an investment or situation? Tolerance Avoidance Antecedence All of the above Question 4 (1 point) Bob is evaluating a bond issue to determine the right price for the bond. In his evaluation, he gathers the following information: N = 8 years INT = .025 or 2.5% PMT = $25 FV = $1,000 (par value) What is the above bond issue worth in today's dollars? $1,000 $1,181.63 $1,200.50 None of the above Question 5 (1 point) In which two ways can risk be defined? Total and market risk Mitigated and unmitigated risk O Risky and very risky None of the above Question 6 (1 point) Which of the following is an example of how companies can mitigate some of an investment's risk? Sell Buy more Short the investment Insurance Question 7 (1 point) A company is evaluating the use of insurance to mitigate its risk in the event of a market downturn. The company estimates that it has a total risk of 20% impact to its net income if a market downturn occurs, and the company currently has a net income of $150,000. At what cost should the company take out insurance to mitigate this risk? $25,000 premium $100,000 premium $150,000 premium $200,000 premium or above Question 8 (1 point) What type of annuity pays at the beginning of a period? Annuities prepaid O Ordinary annuities Annuities due Beginning annuities Question 9 (1 point) What are the three main types of business securities? Preferred, nonpreferred, and trading Debt, savings, and loans Preferred, common, and debt Stock, equity, and debt Question 10 (1 point) How do financial managers tend to value all assets in the same terms? By evaluating cash flows By qualifying cash flows By interpreting cash flows By estimating cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts